By Garrett Buffo

Garrett Buffo originally started working for Altus as an unpaid intern during his senior year in college. I met him in person before he started and was impressed with how much time he had spent, on his own and as a student, to understand real estate analysis. His “internship” was really Andy (our head of acquisitions) teaching him to fully underwrite purchase opportunities all through Zoom (this was the midst of COVID). But we were impressed with his work ethic and reasoning, and we offered him an analyst role upon graduation. Since that time he has continued to learn and has taken on increasing amounts of responsibility. He is one of the few people that love real estate and investing as much as I do and over lunch a couple weeks ago…well…I will let him tell the story.

– Forrest

I had lunch with Forrest recently, and somewhere between bites I slipped into a rant about how we, as a company, must stay laser focused on what lies ahead. I pointed out the pricing inefficiencies and blind spots shaping investor behavior—explaining how Altus stands apart as a disciplined, entrepreneurial-minded firm while many of our former competitors are no longer in business. I stressed that this fragmented market presents a rare opportunity. To capture it, both our team and our investors must adopt a confident, forward-looking mindset.

Forrest just smiled and said: “Congrats, you’re writing the Altus Insight this month.”

I joined the Altus acquisitions team in 2021, during one of the most bullish periods in commercial real estate history. Cheap capital and endless optimism fueled a buying spree. Syndicators were acquiring multifamily assets at peak valuations, quickly expanding into secondary and tertiary markets.

Deals didn’t pencil. We would often underwrite a purchase price 30% lower than where assets ultimately traded. Even after calling brokers to compare notes and assumptions, we would still underwrite negative or single-digit IRRs for 40-year-old apartments in non-institutional markets. Nothing made sense—until the music stopped.

In 2022, interest rates rose quickly. Renters could no longer absorb double-digit annual rent increases and the only line on the P&L that reliably grew was operating expenses. By 2023–2024, many syndicators faced debt maturities with declining valuations. Some assets went (or will be going) back to lenders. Others entered the “extend and pretend” phase where loan maturities were pushed back to avoid default. We’ve reviewed hundreds (literally) of these deals over the past two years. Many show full equity wipeouts, with limited partners losing all their equity investment.

The number of active real estate investment groups has shrunk significantly. The buyer pool today is much smaller than three years ago. This thinning of competition has created the most compelling buying conditions in over a decade; characterized by fewer buyers, more forced sellers, and performing assets trading at discounts due to a lack of buyer demand rather than operational weakness.

A Case for “Boring” Cash Flow

In today’s market, boring is beautiful. Instead of chasing yesterday’s heavy value-add multifamily deals that required major capital expenditures and aggressive rent growth, much of the opportunity now lies in stabilized, cash-flowing properties in secondary and tertiary markets where fundamentals remain strong, but where those who are making decisions for large investors seem afraid to go.

These assets once traded at 4-5% cap rates but are now available at valuations 25-40% below 2021 prices-even with 90%+ occupancy. In the last cycle, buyers purchased on speculation that someone would pay more tomorrow. Today, we can buy assets for the future based on earnings in the present.

The tradeoff is attractive: year one 7–9% cash yields with mid-teen IRRs upon light-to-no value-add execution. We can focus on operational excellence, trimming unnecessary operating costs when purchasing from operators who don’t prioritize cost control, and executing exterior value-add improvements that don’t negatively impact a properties occupancy.

Consensus Kills Alpha

When I ask equity brokers what institutional and family office investors are looking for, the answer is nearly universal: “2000’s or newer multifamily in growing primary and top secondary markets with positive leverage on day one.”

This herd mentality funnels capital into the same deals, drives valuations up, and compresses returns, thereby hurting LPs the most. As the saying goes: “There is no alpha in consensus.”

Alpha means generating returns above the market average. When everyone agrees on the same investment thesis, competition drives up pricing, leaving little chance for outperformance (alpha). To achieve true above-market returns, you must often go against the grain and take a contrarian stance. For Altus, that means focusing on assets that we can underwrite to above market returns, often because competition is thin. Looking where others ignore, so long as the fundamentals support long-term growth.

Value-Add Then vs. Cash Flow Now

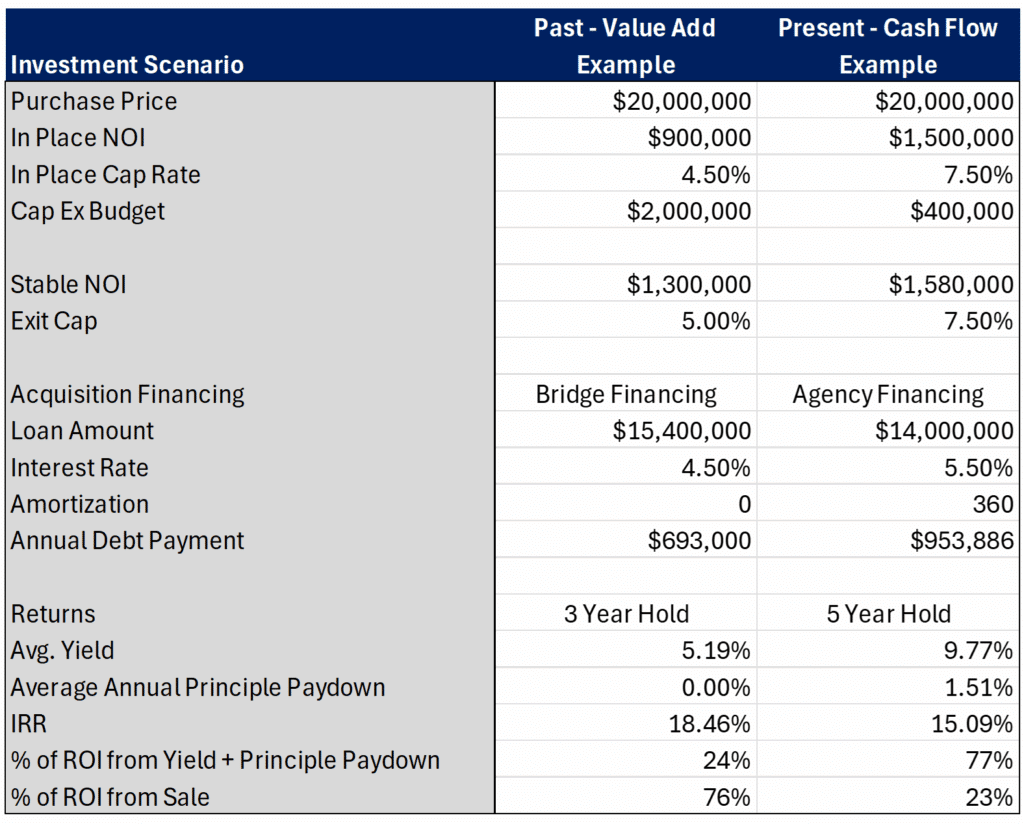

To illustrate the power of predictable yield, I’ve laid out two sample underwrites: one reflecting a typical 2021–2022 value-add multifamily deal, and the other from a recent stabilized cash-flow opportunity.

The Value-Add Model:

In the low-interest-rate era, investors paid premium prices for assets with compressed cap rates and little to no in-place cash flow. IRR was boosted by short-hold periods and ambitious business plans – often dependent on strong rent growth and bullish exit valuations. In our example, this strategy delivered an 18.5% IRR over 3 years, but 76% of those returns came from the sale of the asset. One may argue that is a high reliance on speculation about future market conditions.

The Cash Flow Model:

Today’s market offers a different path. Assuming forward higher cap rates combined with long-term agency financing provides stability. In our example, the deal produces a 15% IRR over a 5-year hold, with over 75% of returns coming from cash flow and principal paydown. This model delivers double the annual yield and debt paydown without needing a successful exit to make the deal work.

WWBD?

These two investment scenarios aren’t a perfect apples-to-apples comparison, largely due to differing hold periods. Value-add strategies often rely on shorter holds to maximize IRR—since IRR tends to diminish over time. But that logic can be misleading. Legendary investors like Warren Buffett have long understood a simple truth: steady, durable returns compounded over time often outperform flashier short-term gains. Shorter horizons require more frequent reinvestment. While reinvestment creates opportunity, it also compounds uncertainty and potential tax exposure. Sometimes the best risk-adjusted returns come not from moving fast, but from holding steady.

What Today’s Market Rewards

In the past cycle, IRR was heavily reliant on exit pricing. Today, cash-flow investments deliver steadier, lower-risk returns, based on predictable yield rather than speculation. What you give up in IRR you gain in certainty. That doesn’t mean value-add deals no longer work. But in this environment, better risk-adjusted returns are often found in higher-yield assets. Even if headline IRRs appear lower, the underwriting is typically far more conservative. Because of this, we expect these deals to outperform pro forma, just as many did coming out of the Great Recession.

Are High-Cash-Flow Deals Everywhere? No!

In today’s market, high-yield multifamily deals are not easy to find and that’s why relationships matter. Over the years, Altus has built strong, trusted connections with brokers across multiple markets. These relationships paired with our reputation has granted us early access to off-market opportunities, when sellers are motivated and trust is key.

A Forward-Looking Lens

Altus is uniquely positioned for this moment. With less than one billion in assets under management: we’re small enough to move quickly, entrepreneurial enough to enter overlooked markets, and advanced enough to leverage AI and technology to source, underwrite, and execute. That combination—discipline, cash flow focus, and a growing technological edge gives us a real advantage while the industry is fragmented, and capital is cautious.

Altus is not immune to the challenges facing commercial real estate, but we’re not burdened by mistakes from the last cycle. With a relatively stable portfolio, a forward-looking acquisitions team, and a growth mindset, Altus and our investors are positioned to capitalize.

Today’s opportunity is rare: motivated sellers of quality assets in overlooked but fundamentally sound markets, trading at prices below their intrinsic value. The best risk-adjusted returns often don’t come from running with the crowd, but from pursuing performance where capital has lost interest.

At Altus, that’s where we’ll be looking.

About the Author

Garrett Buffo

Acquisitions Associate

Garrett joined Altus Equity Group in the summer of 2021 and serves as an Acquisitions Associate. He plays a key role in sourcing and evaluating real estate investment opportunities, with a focus on broker relationships and market underwriting.

Garrett graduated from California State University, Chico with a Bachelor of Science in Finance and a minor in Entrepreneurship. During his time at Chico State, he served as treasurer of the Kappa Sigma Fraternity and was an active member of the university’s Investors Club.

He currently resides in Petaluma, California with his wife, Karina. Outside of work, Garrett volunteers as a football coach at St. Vincent de Paul High School, where he’s passionate about mentoring student-athletes and giving back to his community.