It has been a few months (December) since I provided any Altus Insight content, and some interesting things have happened since then. Before I jump in, one of our readers had the idea that we should ask readers for topic ideas for future Insights. Great idea! If you have anything you would like discussed, please send us an email at investors@altuequity.com, and we will try to address in a future Insight.

It is sure to be a party: We now know, pending unforeseen circumstances, who the candidates will be for the major political parties in the coming presidential election. The USA is the hegemon of the world, the historical banner bearer of democracy, and has a population of over 330 million people – approximately 55% of which are eligible to run for president. I am gobsmacked that as a country we can’t come up with any better candidates other than which we have been presented. The incumbent has the worst approval ratings of any president in history. The challenger is a megalomaniac has 88 outstanding criminal counts across four different indictments. And even without the charges, has exhibited zero desire to show kindness nor grace, nor be a president for anyone other than his most ardent supporters. At this point the vote between these two horrible candidates is largely a toss-up.

As an investment company, Altus is fine taking on risk if the expected returns associated with that risk make it worthwhile, but we always, always(!) want to avoid catastrophic risk (i.e. how we dealt with debt over the past several years). Looking back on the last two administrations, the current geopolitical landscape is almost certainly lining someone up for catastrophic type risk. Whether it is something like the cancellation of the Keystone Pipeline, new and draconian tariffs, massive government stimulus that leads to exploding inflation, or heaven forbid, a hot war.

Growing discrepancies in employment numbers: Some economic analysts started raising the alarm about the divergence in the BLS household employment survey and the BLS establishment survey back in July of 2022. The establishment survey is generally less accurate but is reported earlier after the close of each month and therefore gets far more attention. Generally, the two measurements track each other pretty closely with some volatility around the monthly reporting. However, from March to July 2022, the gap between the two measurements grew to 1.5 million jobs. That measurement gap has not corrected, but rather has continued to grow, despite consistent downward revisions by the BLS. It has now grown to a 5 million worker discrepancy. There are some explanations… an increase in people holding multiple jobs (100% of job growth over the past year has been part-time jobs) and jobs going to foreign-born workers that might not be being captured by the household survey. But that certainly does not explain the entire discrepancy. It turns out there was indeed a measurement error that made employment look far stronger than it was in actuality. The Philadelphia Fed released a report titled Early Benchmark Revision of State Payroll Employment reviewing the April – June 2022 quarter where it acknowledged some serious errors. Quoting from the reporting, “In the aggregate, 10,500 net new jobs were added during the period rather than the 1,121,500 jobs estimated by the sum of the states; the U.S. CES estimated net growth of 1,047,000 jobs for the period.”

This is a sizable error, which unfortunately calls into question the dependability of other government supplied economic data, especially when the data paints an overly optimistic picture that benefits the powers that be.

More impactfully for most of the readers of the Altus Insight, would a true picture of employment growth have changed the actions of legislators or the Fed? This information coming to light is unlikely to become big news on Wall Street. At two years old, it is well out of the current news cycle. But if numbers from that period were wrong, we can probably assume other labor numbers are wrong, and at some point, this plays into inflation, household earnings, and interest rates. Which will certainly have an impact on us as investors.

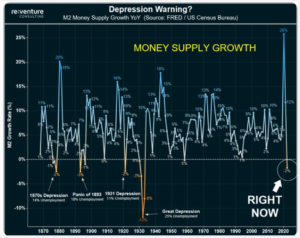

Not since the Great Depression has the monetary supply as measured by M2 contracted in any meaningful amount. According to the Federal Reserve Board of Governors, since July 2022 (there is that July time frame again…) and through the end of February 2024, M2 has fallen by 4.21%. Going back to the Civil War era, there have only been four previous times this has occurred: 1878, 1893, 1921, and 1931-1933. In all four of those cases there was a resulting deflationary recession and double-digit unemployment. Will this time be different? Quite possibly. Due to the incredible stimulus unleashed during COVID the M2 increased an unprecedented 26% in a single year.

Growing backlash by both parties against large corporations is leading to some truly head scratching decisions, as seen in the Justice Department’s decision to sue Apple under antitrust laws for… get this… being overly dominant in the smartphone market. No. Seriously. Shame on Apple for trying to sell more phones and take more market share, all without buying or partnering with their competitors. I am teased often and mercilessly for being a Droid user, and I really do like the droid operating system better, but I get that most people much prefer Apple. I guess the government feels that Apple (an American company) should be less excellent at what they do so other phone companies don’t have to improve as much to compete (Samsung, a Korean company sells the second most phones with a 23% market share).

Nvidia stockholders should beware. It has a 95% share of AI chips, so could be the next company in the DOJs crosshairs. After all, the government is giving Intel $8.5 billion to help them be more competitive (and up to $11 billion in loans). They aren’t going to want to see that money go to waste.

Then in the world of real estate, no one seems to know what is going on. Below is a screenshot of my email inbox. “Why Hasn’t the Distress Been Worse?” And “It’s a Long Way to Bottom.” Same publication, one day apart. A reminder that talking heads (and I guess that means me with the writing of this Insight), largely have no idea what is going on.

But there is some good news in the world of real estate. In research provided by investment firm MSCI, the spread between commercial mortgage rates and corporate bonds is at its highest point in the past twenty-four years. This means, relative to corporate bond rates, it is more expensive to finance real estate than it has been since the tech bubble. This is bad news for anyone trying to refinance out of ballooning debt or finance a new purchase with long-term debt. But, for buyers (like the Altus Opportunity Fund) it could be viewed as really good news; so long as the numbers make sense to make a purchase and the purchase can afford the higher debt cost. If debt costs are at a multi-decade high, they are more likely to go down in the coming years than up. Not guaranteed by any stretch, but at least likely. Should this occur we have reached a point in the market correction where there is a long-term tailwind to valuations.

Happy Investing.

About the Author: Forrest Jinks is CEO of Altus Equity Group Inc and a licensed real estate broker. Forrest has decades of experience as principal in a variety of alternative investment segments including real estate (residential rehab, in-fill development, multi-family, office and retail), debt, and small business start-up (online marketing and site retail). He can be reached at fjinks@altusequity.com.