January was quite the month. Of the forty-six people to hold office prior to Trump’s 2nd inauguration, only Grover Cleveland had won a second term after being out of office. The transition wasn’t particularly smooth, but of greater concern is that the outgoing president showed complete disregard for honesty and a disdain for the rule of law with his actions. While the incoming president did exactly what he said he was going to do in likewise showing a disdain for the rule of law. Worse, the non-president leaders of both parties largely lined up in support of the actions taken. As a citizen of this country, that there are no leaders willing to stand up for the rule of law and decency is highly concerning. And now, a proposed amendment to allow a third a third term? Are you kidding me? Regardless of who is in power, this road we are on leads only towards one destination – authoritarianism.

It is also highly concerning for real estate investors as well, whether as a component of an investment portfolio or as the core business of a company like Altus. Consistent interpretation of, and respect for, the law is a vital part of what makes real estate an attractive investment class. Property rights are based on that law. Without property rights, and especially with an inconsistent application of the law, the dependability of real estate is bastardized into “who you know”. Instead of eliminating the so-called “deep state”, this erosion of legal normalcy is empowering those with power further.

This craziness in the highest office in the land will take time to make its way down to the individual municipal level where most of the impacts of the rule of the law are felt. How much time? No one yet knows. It will largely be dependent on how the judiciary holds up against the pressure, and whether those responsible for enforcing judicial rulings are willing to do so. This could be years and years into the future. And will be if the legal system remains resilient and most of the enforcers of the courts’ decisions are more committed to the laws than are loyal to our presidents/governors/etc.

Another slow-moving train that is disconcerting is the federal deficit and national debt. Most people (readers of the Insight not among them) don’t know the difference between debt and deficit. This includes the media, who in reporting on these things often makes a mockery of the issue by conflating the two words. Defined simply, deficit (and its counterpart and purple unicorn -“surplus”) can be defined as the outcome of a profit and loss statement of the government. Debt is the amount owed as tracked on the balance sheet.

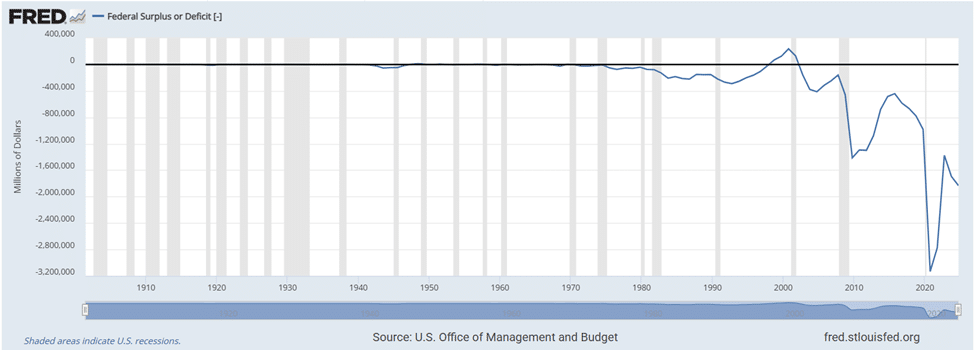

The numbers are staggering. The deficit for the current fiscal year is up 39% (39%!!!!) since the year began on October 1. Imagine running a business where your losses increased 40% in four months. There would be alarm bells going off. But that only tells part of the story. The year ending September 2024 had the third highest deficit ever recorded. EVER. Remember how everyone was shocked by the government spending spree at the end of GW Bush’s term and early in Obama’s term? The largest deficit of that era was in Obama’s first year (2009); and was over $400 billion and 20% LESS than the 2024 deficit. For those of us old enough to remember 2009, it was quite the challenging time. Unemployment had skyrocketed and the economy had imploded. Meanwhile, 2024 was…well… depending who you ask…a great economy. There certainly wasn’t much unemployment. And yet the deficit was waaaaayyyyy larger than 2009. And through this point in time in fiscal 2025…is even waaaayyyyyyy larger still. Below is a graph from the St Louis Federal Reserve. The grey highlighted areas are recessions. When the blue line is above the dark black line the government is running a surplus (only the Clinton surpluses show on the graph); and when below the dark black line, it is running a deficit. Note that most previous spikes in deficits (net annual losses) have been associated with recessions. 2024? Not so much. 2025? Nope, at least not yet. But wait, there is more. Federal tax revenue in 2024 topped $4.9 trillion dollars, the most in the history of the republic. In the same year with the highest revenue ever…the government also posted one of the largest deficits ever. This equates to an obvious conclusion. Government spending in 2024 was absolutely out of control.

It is no surprise that economic measurements stayed positive despite all the headwinds that many in the country were feeling (and certainly being felt in the world of real estate). The government was quite literally propping up the economy. How? By borrowing money, silly. The deficit itself doesn’t directly involve borrowing money, but when there are no cash reserves to draw against (and there wasn’t anything of consequence), it leads to increased government debt. This is where things get worse.

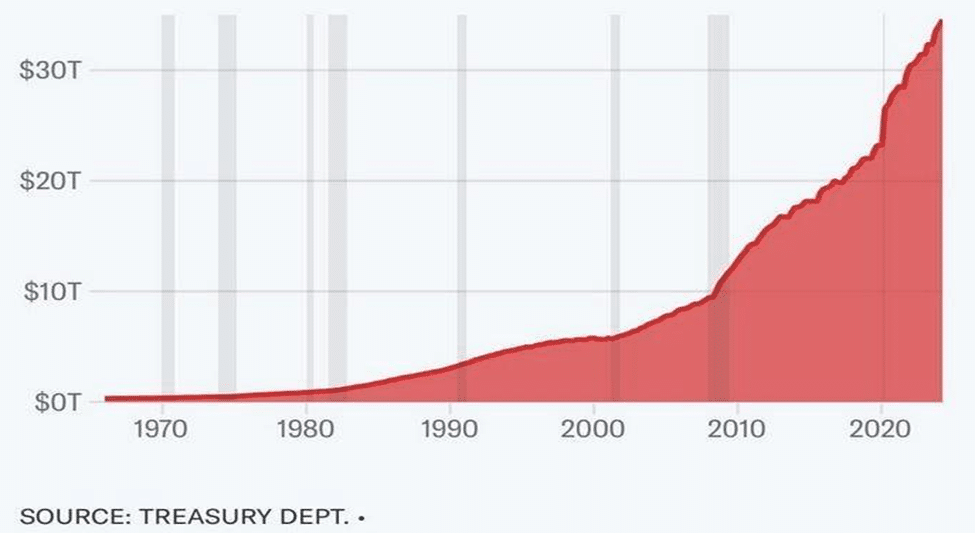

In 2021, after four years of doing everything she could to maximize the negative variance between the market interest rates and the natural rate of interest[i], Janet Yellen became the Treasury Secretary, where she promptly saw three of the four largest deficits in US history. Those deficits, added to the largest deficit in US history in 2020 – the COVID year – without any normalizing gap years (and obviously surpluses) has created a hockey stick effect in total federal debt outstanding (note: this does not include debt added in fiscal Q4 ending September 30th). During the 1st Trump, and then Biden administrations, coinciding with Yellen’s time as Fed Chair and Treasury Secretary, the debt increased more than 75% from the combined debt the entire first 240 years of our country.

Maybe worse, Yellen insisted on funding the government (or said another way – borrowing) with short term debt. In the depths of 2020, and before the government overspending on the Rescue Plan Act in 2021 poured gas on the inflationary blaze, she saved the government (read: taxpayers) a few basis points in interest rate savings. But her unwillingness to lock in longer term debt has completely backfired ever since, as not only have short term rates risen dramatically, for the past few years short term rates have been higher than long term rates (the inverted yield curve). In 2023 alone, U.S. debt increased by $2.2 trillion (according to the government accountability office, and against of deficit of “only” $1.7 trillion). The best I can tell, to pay for this new debt and to pay off expiring bonds, the treasury issued a total of $14.2 trillion in new debt. According to Wolf Street, of that amount, $6.31 trillion was issued as securities less than a year in term. During 2023 alone, debt with less than two years of original term doubled from 15 – 30% of total federal debt. This has cost, or at least will cost, the country billions of dollars in interest expense over time. The cost of servicing the national debt has now grown to the point where simply servicing the interest on the debt now exceeds the entire U.S. military budget. No amortization of the debt balance, just interest.

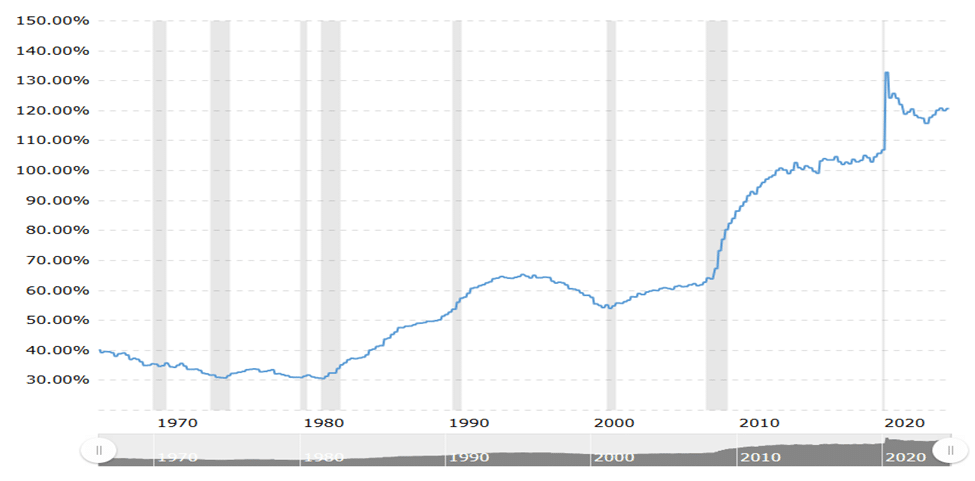

Some argue that it isn’t the government debt that matters, but rather the percentage of debt to the size of the economy. As a real estate investor, I can understand the logic of this argument. All things being equal, a $1 billion real estate portfolio can support 10x the amount of debt of a $100 million real estate portfolio. Unfortunately, the numbers still paint an ugly picture. (Graph compliments of Macrotrends).

How this all ends, no one knows. I think it is safe to say at some point the bond market rebels, and the Federal Reserve loses all control of interest rates. To some degree this has happened in a small extent over the past six months. Even while the Fed was lowering short term rates, longer term rates, which are really what impacts the economy, marched higher. But at what point the bond market truly rebels – when rates spike substantially, or investors refuse to buy the government bonds at all…no one knows.

I have referenced Ernest Hemingways’ quote on bankruptcy in the past. To paraphrase, “It happened gradually and then suddenly.” That’s where we stand today. We don’t know when the “suddenly” will occur. It could be months (probably not), or it could be years. Maybe even decades (again, probably not).

History is full of nations collapsing under the weight of excessive debt. The book “This Time is Different” captures the history of defaults beautifully. These implosions often destroy the national currency. And when the currencies fail, real assets tend to hold value the best. This is gold and silver. This may be bitcoin. And yes, it is most certainly real estate.

Except, of course, when property rights are no longer upheld because the rule of law has been destroyed.

Debt and legal rights, twin issues, moving independently and yet in parallel. Only time will tell the story.

Happy Investing.

[i] The natural rate of interest is the real interest rate that’s neither expansionary nor contractionary