Out of one side of its mouth, the government talks about wanting to help new businesses get established and grow. The other side of its mouth produces a never-ending stream of edicts that make it more and more difficult to start a business. Maybe not for the Stanford or Harvard grads who step into entrepreneurship with substantial training and deep networks (and probably third party funding), but certainly for the main street entrepreneur who is trying to start a business on a shoe string budget while also ensuring they can keep their bills paid and families fed. Both types of entrepreneurs are important for our economy. But over the years as there are more business deaths than births, the main street business is less and less likely to be started. Not only does it impact the economy more broadly, but it also impacts the psyche of the country as it is increasingly harder for people to believe in the American Dream.

Duncan Kelm of Arrow Point Tax Services is a good friend and trusted resource. He is also one of the smartest people I know when it comes to small business, tax, and the government’s involvement in both. Earlier this month he sent out some great information about the new Beneficial Ownership Information (BOI) Reporting Requirements. I asked him to put it into a format we could share with our Altus Insight readers, which he agreed to do. Due to all the information included, this Insight ends up being longer than normal, but it is an important read. Especially if you are a business owner or have any business operation responsibilities.

–Forrest

—————————-

American Entrepreneur Resiliency and New Beneficial Ownership Information (BOI) Reporting Requirement

Since 2017, businesses in the United States have seen dramatic changes in terms of tax and regulation. Many will recall the 2017 Tax Cuts and Jobs Act (“TCJA”) which usered in sweeping tax legislation acrossss the nation. Changes involved: the corporate tax rate, qualified business income, bonus depreciation, qualified opportunity zones, and pass through entity tax elections, to name a few.

In December 2019, the Setting Every Community Up for Retirement Enhancement Act 1.0 (“SECURE Act 1.0”) brought adjustments to qualified (retirement) account rules and regulations. New rules and changes to 401Ks, SIMPLE IRAs, SEP IRAs, and other qualified accounts were implemented. Requirements changed for businesses and how these plans could be implemented and operated.

In early 2020, we all were introduced to Covid-19. Businesses across the United States were impacted asymetrically in countless ways which challenged the resiliency of the American entrepreuer. While no two businesses faced the same challenges, all had their own tests to overcome.

Embedded within the Covid-19 years of 2020 – 2021 were three massive fiscal bills passed under two different presidents:

- First, the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”). The bill touched many areas of the United States economy, but also introduced new programs specifically for businesses. Two of the most common were the well known Paycheck Protection Loan Program (“PPP Loan”) and the Employee Rentention Credit (“ERC”) tax credit.

- Second, the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act was signed in December 2020. The bill extended and expanded Covid-19 programs, ushering in additional programs for specific industries of business hard hit by Covid-19.

- Third, the American Rescue Plan Act (“ARP Act”) became law in March of 2021 under the new Biden administration. This bill again, expanded and added to Covid-19 realted programs. Businesses were again a significant focus of these changes.

In 2022, as the reopening of the United States Economy progressed and entrepreneurs began to move beyond Covid-19, two more bills with sector specifc focus passed:

- First, the Creating Helpful Incentives to Produce Semiconductors Act (“CHIPS Act”) passed in August 2022. The bill focused on reshoring silcon chip manufacturering offering large incentives to entreprenerus who meet these objectives.

- Second, the Inflation Reduction Act (“IRA Act”), passed later in August 2022. With a slightly misleading name, this bill actually brought sweeping legislation changes for clean energy businesses over a ten year period. The bill incentivizes a heavy push into clean energy by leveraging transferable tax credits.

Finally, in the last few days of 2022, the Setting Every Community Up for Retirement Enhancement Act 2.0 (“SECURE Act 2.0”) passed. Ushering in further laws beginnning in 2023 tied to qualified (retirement) accounts.

All these regulations arrived while the United States saw long forgotten inflation reemerge, a rapid increase in interest rates, a mini credit event in regional banking, and a tight labor market with an accelerating wage cycle. The prior six years were filled with dynamic change for individuals and businesses alike. Through this, the United States entrepreur remained resilient and continued on.

An old adaddage from Heraclitus, is that “the only constant in life is change.” Based on the last six years, it might be more apt to adjust the quote to “the only constant for the American entrepreneur, is consistant change.” 2024 will be no different.

Starting January 1, 2024, a significant number of businesses will be required to comply with new reporting laws related to the Corporate Transparency Act (“CTA”). The CTA was enacted into law as part of the National Defense Act for Fiscal Year 2021. The CTA requires disclosure at the federal level of beneficial ownership information (otherwise known as “BOI”). Entities will be required to report all people and other entities who own, impact, or control a company.

The CTA is not a part of the tax code. Instead, it is a part of the Bank Secrecy Act, a set of federal laws that require record-keeping and report filing on certain types of financial transactions. Under the CTA, BOI reports will not be filed with the IRS, but with the Financial Crimes Enforcement Network (“FinCEN”), another agency of the Department of Treasury.

These new FinCEN laws require businesses to report ownership percentage and ownership details at the national level. However, it does not only include ownership. Any person, entity, or group that could be seen to have control or influence in business matters is considered a beneficial owner and is required to be registered with FinCEN.

It is anticipated that 32 million businesses will be required to comply with this new reporting requirement. The intent of the BOI reporting requirement is to help US law enforcement combat money laundering, the financing of terrorism and other illicit activity. With enactment, most businesses will be forced into regular reporting.

Below are some key points that businesses and investors alike should be aware of as it relates to BOI. This information is meant to be general-only and should not be applied to specific facts and circumstances without consultation with competent legal counsel and/or other retained professional advisors.

What entities are required to comply with the CTA’s BOI reporting requirement?

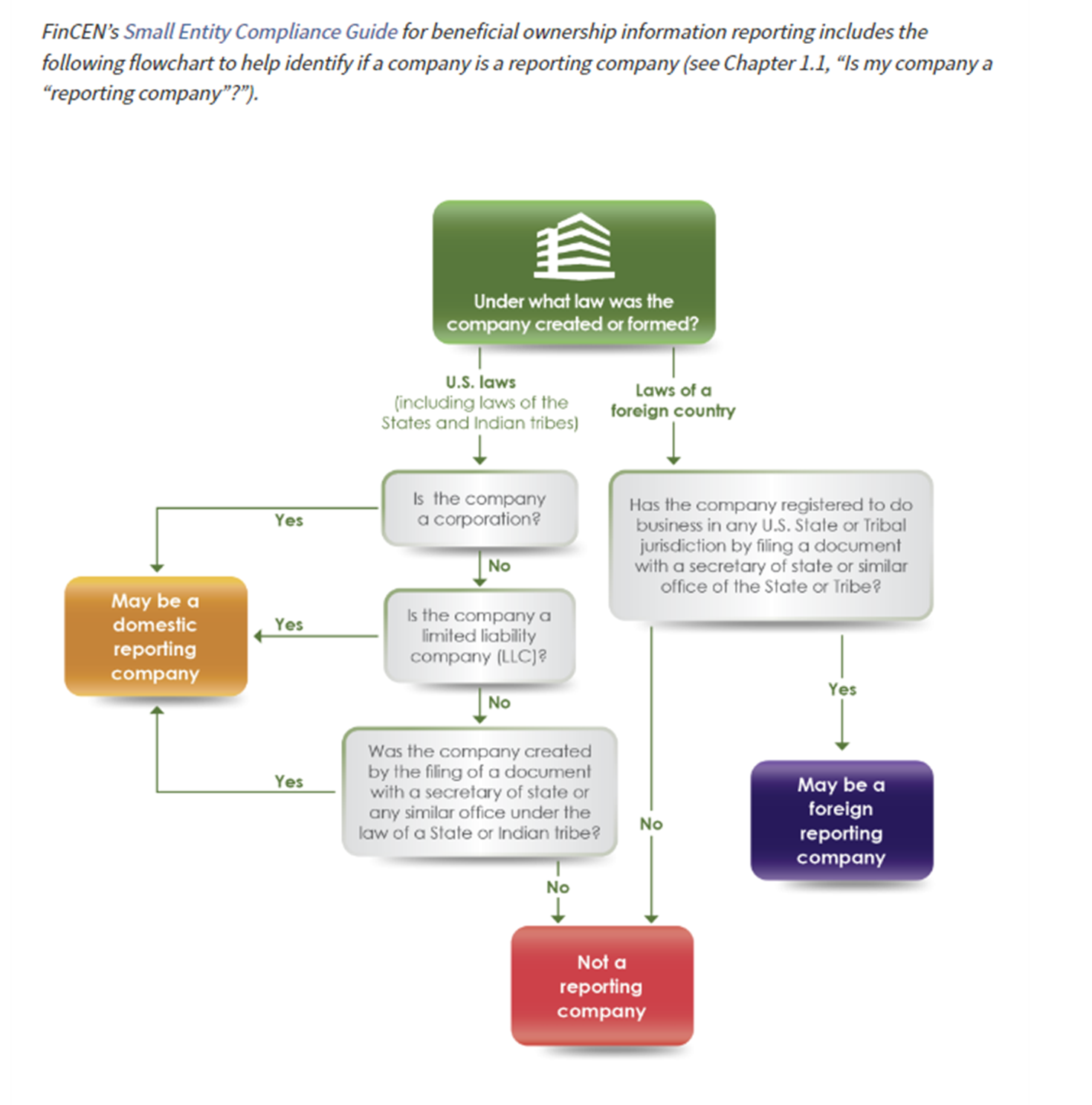

Entities organized both in the U.S. and outside the U.S. may be subject to the CTA’s reporting requirements. Domestic companies required to report include corporations, limited liability companies (LLCs) or any similar entity created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe.

Domestic entities that are not created by the filing of a document with a secretary of state or similar office are not required to report under the CTA.

Foreign companies required to report under the CTA include corporations, LLCs or any similar entity that is formed under the law of a foreign country and registered to do business in any state or tribal jurisdiction by filing a document with a secretary of state or any similar office.

See chart provided by FinCEN below:

Are there any exemptions from the filing requirements?

There are 23 categories of exemptions. Included in the exemptions list are publicly traded companies, banks and credit unions, securities brokers/dealers, public accounting firms, tax-exempt entities and certain inactive entities, among others. Most of the businesses that will be required to file reports will be small or closely held businesses. Please note these are not blanket exemptions and many of these entities are already heavily regulated by the government and thus already disclose their BOI to a government authority.

In addition, certain “large operating entities” are exempt from filing. To qualify for this exemption, the company must:

- Employ more than 20 people in the U.S.;

- Have reported gross revenue (or sales) of over $5M on the prior year’s tax return; and

- Be physically present in the U.S.

Who/what is a beneficial owner?

Any individual who, directly or indirectly, meets one of the following criteria:

- Exercises “substantial control” over a reporting company. An individual can exercise substantial control over a reporting company in four different ways. If the individual falls into any of the categories below, the individual is exercising substantial control:

- The individual is a senior officer (the company’s president, chief financial officer, general counsel, chief executive office, chief operating officer, or any other officer who performs a similar function).

- The individual has authority to appoint or remove certain officers or a majority of directors (or similar body) of the reporting company.

- The individual is an important decision-maker for the reporting company.

- The individual has any other form of substantial control over the reporting company as explained further in FinCEN’s Small Entity Compliance Guide (see Chapter 2.1, “What is substantial control?”).

- Owns or controls at least 25 percent of the ownership interests of a reporting company.

- An ownership interest is generally an arrangement that establishes ownership rights in the reporting company. Examples of ownership interests include shares of equity, stock, voting rights, or any other mechanism used to establish ownership.

An individual has substantial control of a reporting company if they direct, determine or exercise substantial influence over important decisions of the reporting company. This includes any senior officers of the reporting company, regardless of formal title or if they have no ownership interest in the reporting company.

The detailed CTA regulations define the terms “substantial control” and “ownership interest” further.

When must companies file?

There are different filing timeframes depending on when an entity is registered/formed or if there is a change to the beneficial owner’s information.

- New entities (created/registered in 2024) — must file within 90 days

- New entities (created/registered after 12/31/2024) — must file within 30 days

- Existing entities (created/registered before 01/01/2024) — must file prior to 01/01/2025

- Reporting companies that have changes to previously reported information or discover inaccuracies in previously filed reports — must file updates within 30 days

What sort of information is required to be reported?

Companies must report the following information: full name of the reporting company, any trade name or doing business as (DBA) name, business address, state or Tribal jurisdiction of formation, and an IRS taxpayer identification number (TIN).

Additionally, information on the beneficial owners of the entity, and for newly created entities, the company applicants of the entity is required. This information includes — name, birthdate, address, and unique identifying number and issuing jurisdiction from an acceptable identification document (e.g., a driver’s license or passport) and an image of such document.

Risk of non-compliance

Penalties for willfully not complying with the BOI reporting requirement can result in criminal and civil penalties of $500 per day and up to $10,000 with up to two years of jail time. For more information about the CTA, visit www.aicpa-cima.com/boi.

Additional Resources and Information

This requirement is something that most clients will need to address in the coming year. We strongly encourage each of you to familiarize yourselves with this new requirement, and understand the deadlines and severe penalties associated with non-compliance.

Other helpful resources are as follows:

- Official FinCEN BOI Filing Site: https://www.fincen.gov/boi

- FinCEN BOI FAQ: https://www.fincen.gov/boi-faqs#B_1

- FinCEN BOI Summary PDF: https://www.fincen.gov/sites/default/files/shared/BOI%20Informational%20Brochure%20508C.pdf

- FinCEN BOI Informational Video: https://www.youtube.com/watch?v=qQ5ABgZ6Xn4

Yours Sincerely,

Duncan Kelm

Arrow Point Tax Services – “Forward looking, not retro filing”

1011 2nd St, Ste 101

Santa Rosa, CA 95404

Day time phone: 707.382.3905

Email: Duncan@arrowpointtaxes.com

Website: https://www.arrowpointtaxes.com/

About Arrow Point Taxes and the Author

Arrow Point Tax Services is a forward looking, full suite, tax firm. The firm focuses on small business tax, real estate tax, estate tax, and advanced tax strategies.

Duncan Kelm is an Enrolled Agent and Managing Partner of Arrow Point Tax Services. Duncan and his wife Katherine are the proud parents to three young children. Duncan is a native Santa Rosian, former Olympic rugby player, and entrepreneur.