The Power of Depreciation

By David Gunning

As real estate investors, most of us have a general understanding that depreciation is something beneficial – something that acts as a write-off against income and can help us save money on taxes. But for many of us, beyond that, things are a little bit nebulous, and we are thankful that we have accountants to figure it all out. When we are presented with real estate investment opportunities, these potential tax savings aren’t marketed or presented to us because they don’t take place at the deal level. But, to the extent they save us on taxes, they do play an important part in the effective rate of return on our investments. Since depreciation is such an important tool in increasing our effective returns, this article will examine what depreciation is and how it can be used to our advantage.

Depreciation in its simplest form is the reduction of the value of an asset over time, particularly due to wear and tear. Depreciation is most valuable to us as real estate investors when viewed from an accounting point of view. From an accounting perspective, depreciation is used to allocate the cost of a tangible or physical asset over its useful life. It represents how much of an asset’s value has been used. To the extent that a real estate asset is used, the IRS deems it fair to write off that usage as a depreciation expense. As the depreciation is written off, the “basis” of the asset is reduced (more on that later). To be eligible to claim depreciation:

- You must own the property (you are considered to be the owner even if the property is subject to debt).

- You must use the property in your business or as an income-producing activity.

- The property must have a determinable useful life, meaning it’s something that wears out, decays, gets used up, becomes obsolete, or loses its value from natural causes.

- The property is expected to last for more than one year.

- The property is placed in service i.e., ready and available for use.

Even if the property meets all the above requirements, it cannot be depreciated if you place it in service and dispose of it (or no longer use it for business use) in the same year.

There are several methods of calculating depreciation, but the most common one in real estate is Straight Line Depreciation.

Straight Line Depreciation reports an equal depreciation expense each year throughout the entire useful life of the asset until the entire asset is depreciated to its salvage value. Residential Real estate can be depreciated over 27.5 years, and commercial real estate can be depreciated over 39 years. Note: the portion of the property value that can be depreciated is the improvements. The land is not depreciable. For example, suppose you have $1,000,000 to purchase an investment property and plan to use straight-line depreciation. Assuming a land value of $300k and improvements of $700k the straight-line annual depreciation would be as follows:

- For a residential property: $25,454 ($700k / 27.5)

- For a commercial property: $17,948 ($700k / 39)

The second method of depreciation is called Accelerated Depreciation. As the name implies, this accounting method allows the owner of an asset to depreciate the asset more quickly by using a shorter period of depreciation than the traditional straight-line method. To do this, property owners will need a Cost Segregation Study.

What is Cost Segregation?

Cost Segregation (referred to simply as “Cost Seg”) is a process that identifies tax-savings opportunities for taxpayers who have purchased, constructed, or renovated a building. These studies should be performed by professionals with construction, engineering, and tax experience to correctly segregate the costs of your assets into either 5, 7, 15, 27.5 or 39-year lives. The goal is to appropriate as many assets into the 5-, 7- and 15-year buckets to frontload as much of the depreciation as possible.

Another type of Accelerated Depreciation is Bonus Depreciation, which was an incentive originally created to stimulate the economy after the 9/11 terrorist attacks and was later enhanced as part of the 2017 Tax Cuts and Jobs Act (TCJA). Assets eligible for Bonus Depreciation can be written off in the year they are placed into service, according to the following, diminishing schedule. For assets acquired after Sept 27, 2017 (and placed in service before December 31, 2022) 100% can be written off in the first year. The phase out schedule is as follows:

- 2022 100%

- 2023 80%

- 2024 60%

- 2025 40%

- 2026 20%

- 2027 0%

Note: Prior to the TCJA, Bonus Deprecation was maxed at 50%.

One type of Bonus Depreciation, made possible as part of the CARES Act, is Qualified Improvement Property (QIP). QIP is defined as improvements made to the interiors of non-residential buildings. Note, the QIP needs to be made by the taxpayer, meaning you cannot acquire a building and treat any cost assigned to improvements made by a previous owner as QIP.

Since these types of accelerated depreciation serve as an expense and can lower your taxable income and reduce your tax liability – the sooner you can claim deductions on your tax returns and save money, the higher your effective ROI (return on investment) is over the life of the investment. Given Cost Segregation’s propensity to accelerate your investment returns, Altus reviews all its investments with its tax accounting firm, Moss Adams, to determine whether each investment would benefit from Cost Segregation. Projects likely to benefit from Cost Seg are newly purchased, constructed, expanded, or remodeled properties over $2M. For smaller projects, and/or projects that don’t have a significant amount of assets eligible for accelerated depreciation, Cost Seg may not be advantageous. Generally speaking, residential and hospitality projects will receive the greatest benefit from a Cost Seg study, followed by office, retail, and industrial.

Are the benefits of Depreciation Permanent?

In most cases, the benefits are temporary in that the payment of taxes for the portion of the value that is depreciated is deferred. When the asset is sold down the road, taxes are due on the portion of value that was written off. This is referred to as “depreciation recapture”. Using the example above, if you took $200k in depreciation, and sold the asset for $1.3M, you would pay depreciation recapture taxes on the $200k that was depreciated. And you would pay capital gains taxes on the gain of $300k ($1.3M sales price -$1M purchase price). The federal depreciation recapture tax rate for 2023 is 25%. The federal long-term capital gains tax rates for 2023 are 0%, 15%, or 20% depending on your tax filing status. Even with the taxes owed on the recapture of the depreciation, the ability to write off the depreciation is still a net benefit for two reasons. First, the tax rate for most Altus Insight readers is higher than 25%, meaning there is a differential between the value of the write-off (higher than 25%) and the cost of the recapture (25%). Second, and quite powerful, is the time value of money. In the example above, assuming straight-line depreciation, a ten-year hold, and a 10% IRR, this equates to $103,000 in extra post-tax income over the ten-year life of the investment. Assuming a 35% tax bracket there is an additional $20,000 in net tax savings over that same time period. None of which includes any benefits at the state income tax level.

Are there ways around paying the depreciation recapture and capital gain taxes?

Yes. There are three ways:

- The first way is to do a 1031 exchange, whereby you sell your investment property and purchase a like-kind property. This essentially buries your gain into the new property – in the sense that the “basis” of the new property is now reduced by the gain, and depreciation is recaptured in the sale of the old property. This is the most common tool employed by real estate investors and it serves to “kick the can down the road” as far as paying taxes. Investors will often exchange a property multiple times over the years, continually lowering the basis.

- The second way is much less desirable! Upon death, the basis of the property will increase to the then current value of the property as it passes to heirs. The most common method to establish this value is to get an appraisal done by a professional real estate appraiser. Note that this method is often used in conjunction with 1031s so that value a taxpayer is able to maximize cash flow during their lifetime and still pass equity to their heirs at the stepped up basis.

- The third, and much newer, way involves investing in a Qualified Opportunity Fund that holds real estate. Qualified Opportunity Funds (QOFs) are special funds for the purpose of accepting investment capital. The QOF, in turn, can invest in a Qualified Opportunity Zone property or business. Qualified Opportunity Zones (QOZs) are low-income census tracts designated by each state’s governors as part of the TCJA in 2017. The legislation, which received bipartisan support, aims to spur economic growth in these low-income areas. In order to persuade investment into these areas the legislation committee ultimately decided it would be best to tie it to capital gains incentives. At the time, American investors were sitting on an estimated $1T of capital gains, tied up in assets that they didn’t want to sell because they didn’t want to pay capital gains. In order to capitalize on some of these idle assets, Qualified Opportunity Zones were created, and the legislation was passed. Investors were given a compelling reason to take capital gains and reinvest them into Qualified Opportunity Funds. A brief overview of the legislation is as follows:

- For people who have capital gains and invest them within 6 months of the gain being realized, they can invest all or part of those capital gains into a Qualified Opportunity Fund (QOF) to get certain tax benefits.

- The QOF, in turn, must invest in either a QOZ property or a QOZ business. Note: regardless of this distinction, when discussing these types of investments, they are typically referred to simply as “QOZs” or “QOZ deals” even though the money is being put into a QOF.

- These investments must meet strict guidelines to demonstrate that they are bringing value to these low-income areas.

For people who invest their capital gains in QOF funds compliantly, the IRS says “thank you” in the following ways:

- You can defer the capital gains payment on the gain until the December 31, 2026, tax year. Note: legislation was introduced last year to extend this until December 31, 2028. With the new congress, we are hoping it gets reintroduced and passes.

- The capital gains owed can be discounted up to 15% if held in the fund for 5 or more years if it was invested by December 31, 2021. This benefit has sunset, although we are hopeful that new legislation extends it as mentioned above.

- If an investor’s QOF investment is held for 10 years or more, upon liquidation, they can make a one-time election to increase the basis of their investment to the then, current value. This is a huge benefit in and of itself, and has two distinct beneficial aspects:

-

- The investor pays NO federal taxes on the appreciation. In 2023 Federal Capital gains are taxed at 0%, 15%, or 20% for single filers: 0% up to $44,625, 15% for $44,626-$492,300, and 20% above $492,300. For married filing jointly filers the tiers change to $89,250 and $553,850. States vary on their level of generosity here, and unfortunately, California is not one of the states that waive capital gains tax on QOFs. California treats capital gains as income regardless of whether short-term, long-term or inside or outside of a QOZ. They are taxed at the same rate as regular income, in 2023 ranging on a progressive basis from 1% up to 13.3%.

- There is a hidden benefit, and that benefit is HUGE: at any time after 10 years, the basis of your investment in the fund the basis of the fund can be stepped up to its current market value. As a result, you don’t have to pay taxes on the recaptured depreciation.

Being able to step up the basis and avoid paying the tax on depreciation recapture and the capital gains tax are the two primary value drivers of QOZ tax legislation.

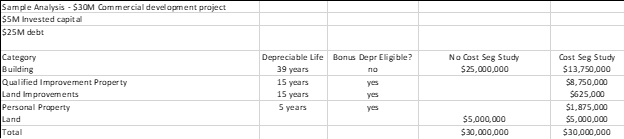

In the following tables, we’ll look at the enhancing effects of Cost Seg on a sample commercial real estate development deal, both from Non-QOZ and QOZ lenses. n our sample deal we’ll have the following assumptions:

- Equity raised for land: $5M

- Loans for improvements: $25M

- Total project cost: $30M

- 10-year hold

Table 1

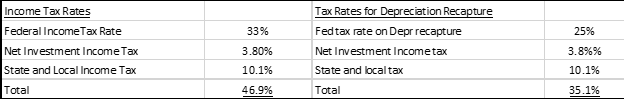

For tax rates, we’ll make the following assumptions:

- Investors are married, making $500,000 / year

- They live in California

- They are in the top tax brackets, but we are using average tax rates

Table 2

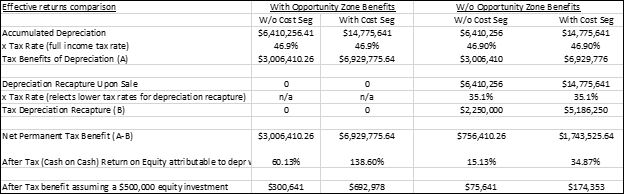

Now let’s look at the effective returns in Table 3.

Table 3

Results

Depreciation on its own boosted the total returns by over 15%. And when a Cost Seg study was added that boosted returns to almost 35%. Opportunity Zone deals w/out Cost Seg came in third with 60% returns. And Cost Seg and QOZ combined yielded a return of over 138% of the investment. Again – all of these are only the effects of depreciation. They do not take into consideration deal-level economics. It is important to note that part of the benefit comes from tax arbitrage, in that we are getting a write-off at an average tax rate of 46.9%, but when we go to recapture the depreciation, we only have to pay 35.1%.

Given all of this, should I sell everything I own and focus only on Qualified Opportunity Zone investments with Cost Seg? Not necessarily. Cost Seg and QOZ investments are very powerful but can have their own limitations as far as how effective they will be for you. As always, please check with your accountant to see if these features are good for your particular tax situation.

Things to keep in mind regarding Cost Seg:

- For smaller deals, Cost Seg may not make sense. Cost Seg benefits are more pronounced as the deal size increases. To offset the cost of a Cost Seg study, a deal must be a certain size to break even on the expense. An accountant or Cost Seg expert can usually give you a preliminary sense of whether it would be worthwhile to pay for a study.

- Different projects and property types will have different proportions of assets that can be accelerated or reclassified into shorter depreciation buckets. This may range from 10% to 50% of the assets.

- Bonus Depreciation will decrease in 2023 to 80%, and then 20% per year thereafter until it sunsets.

Things to keep in mind regarding QOZ Investments:

- The investment itself needs to make financial sense. The QOZ benefits and Cost Seg benefits need to be considered icing on the cake. If the underlying investment itself is not a good one, then the added benefits we’ve been discussing will be minimized.

- QOZ investments require patient capital. The funds need to be deployed in a QOF for 10 years to get the benefits described above.

- QOZ investments have nuanced tax requirements. Be sure to work with a sponsor who is experienced in dealing with QOFs and the labyrinth of legal requirements surrounding them. Working with Moss Adams and our legal team (Beyers Costin) Altus and I have facilitated several such investments over the past few years.

Things to keep in mind regarding depreciation in general:

- Depreciation can only be used to offset certain types of income: The depreciation deductions are limited to the amount of rental income (passive income) and cannot be used to reduce ordinary income unless you can qualify as a real estate professional. If enough passive income is not available as an offset, the passive loss will carry forward into the following tax year as a Net Operating Loss (NOL). If you don’t have sufficient passive income, the benefits of depreciation will be limited.

- Depreciation requires basis. Your basis in QOZ investments will be zero until you pay your capital gains tax with your 2026 tax returns. Debt, in many instances, can serve to increase an investor’s basis depending on how your operating agreement is written and what type of debt you have. When possible, Altus makes every effort to ensure its partners receive that benefit.

- Depreciation only kicks in when the project is placed into service.

Depreciation is a very powerful tool that can be used to substantially boost effective after-tax earnings. Like an engine being supercharged, it may offer more power than what is needed. But for an otherwise good-looking real estate deal, located in an Opportunity Zone, and factoring in Cost Seg – you can get some serious boost. And for investors with passive income, that can be very valuable. As always, check with your accountant to see how you can take full advantage of depreciation.

Happy Investing!

David Gunning is the Principal of QOZ Partnerships LLC. In 2018 David sold his portfolio of residential homes to divest into QOZs and has never looked back. He is an Investor and Co-Fund Manager for several of Altus Equity Group’s QOFs. He is a third-generation San Franciscan, and currently lives there with his family, but spent many of his formative years growing up in the Sonoma County wine country. Feel free to reach out to David with any questions about QOZ investing. david@davidgunning.com

Article Sources: