I have been asked over the past few weeks whether I was planning on doing my normal pre-election Insight outlining the tax and economic plans of each candidate and what the impact of each might be. My answer, very simply, was No. The amount of emotion and tribalism around the election is substantial, and there isn’t enough value for me (or Altus) to insert ourselves in the middle of it. This is unfortunate, because there are intelligent and thoughtful people on both sides of the argument. As a country and a society, we would benefit greatly from being able to listen to the viewpoints of someone with whom we disagree. If we could at least get to where we had an understanding of each other’s viewpoints, even if it didn’t change our points of view, maybe we would be able to collaborate on better solutions than the current situation of political prejudice and hysteria that leads to zero sum game outcomes. Most voters are good hearted. Nearly all voters want a better tomorrow for the country. Let’s remember, we are all on the same team.

My plan this month was to write about California, the world’s fifth largest economy, and how changes in/to California may impact the economies of the rest of the country. But with wildfire events once again dragging California into the news for all the wrong reasons, and with the Altus family again being personally impacted, it just doesn’t seem appropriate to take such a deep dive right now.

Instead, just a few economic tidbits:

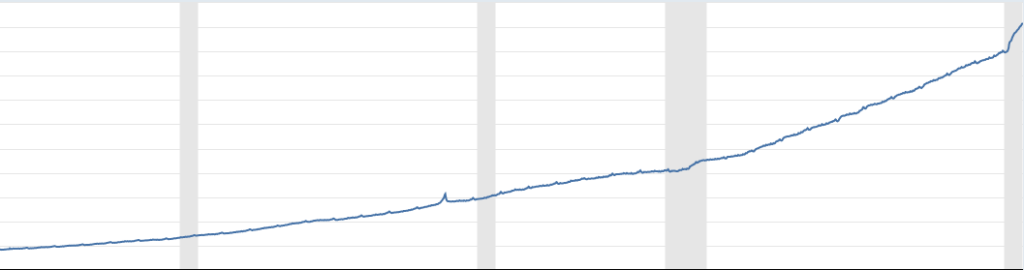

- It wouldn’t be a surprise to many people that there is a ton of money (currency in circulation) floating around the economy right now. It may be a surprise though that as a percentage of the economy, there is a 50% increase over 2009 (measured against 2019 and 2007 GDP as the years prior to the recessions, respectively). Below is a chart from the Fed showing money in circulation going back to 1984. The shaded area on the right is 2020. That is what the investing world calls “going vertical”.

With such an increase in “money”, it might be easy to think that we will see substantial inflation. Anecdotally, we are seeing a rise in many of our daily costs such as food and home prices. Maybe we are in an inflationary period, but there are also some very, very smart people on the other side of the argument (Lacy Hunt of Hoisington Investment Management Company being one of the most prominent).

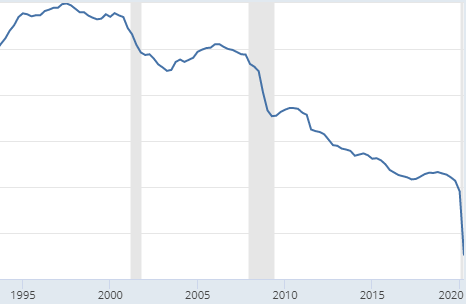

Inflation occurs when the quantity of money in an economy multiplied by the velocity of that money (the number of times each unit of currency is spent each year) is increasing faster than real GDP. Hunt (and others) argue that demographics and the over indebtedness of the US economy have created such a strong downtrend in velocity that we will not see inflation of any meaningful measure for years into the future. This chart from the Federal Reserve of Saint Louis shows the velocity of M2 Money Stock has been falling almost constantly since the mid-1990s, and took a severe, severe turn downward at the end of 2019 before completely falling out of bed in the current recession. Falling velocity is a heavy drag on the possibility of inflation.

The Federal Reserve released new guidance this past month that they were shooting for higher than the 2% previous inflation target (paraphrasing). To accomplish this they either need to reverse the long term velocity downtrend or increase the money supply enough to over compensate for the falling velocity of money. Regardless who wins the election, the Federal Reserve will have a willing compatriot in the White House. Stimulus, whether monetary or fiscal, is likely to speed up the rate of the money supply increase even further than what the first graph captured. Handsome returns can be realized for anyone that guesses the ultimate outcome, and acts upon it. If you are convinced that the Fed can achieve its new inflation goal, then buy lots of anything “real” and leverage it up as high as you can possibly afford would be the play. If, like Lacy Hunt, you believe that inflation will continue to be muted for the foreseeable future, then buy debt instruments. They will benefit from falling interest rates tied to the absence of inflation. I am not one to be enough convinced of my guesses to put all my chips on one color or the other.

- We are told that because of COVID and the ensuing boom in the ability to work remotely, that people are fleeing cities and moving to small towns. That headline, while true, doesn’t tell the whole story. Using home prices as a proxy (since population statistics are much delayed), people aren’t fleeing all cities, they are fleeing the major cities. Secondary cities, especially away from the coasts, are seeing a huge population influx. San Francisco may be hurting but places like Salt Lake City, Austin, and NW Arkansas are booming. Making decisions from headlines without digging into the true story could cause us to make less optimal investment decisions than we might have otherwise made. As an aside, according to data provided by Wells Fargo, rents in San Francisco are plummeting at a rate more than double any other decent size metro in the country.

- It has also been reported that we are currently seeing economic recovery among the upper socio-economic groups, while those on the lower end of the spectrum continue to lose ground. The widening rich/poor (or high/low earner) gap is personally alarming, but this particular claim is inaccurate. The economic collapse in Q2 hit all of the economic strata to some degree or another. There is no question those on the lowest strata took the biggest hit. By the end of March, only a couple weeks into the shutdown, over 50% of those making under $40,000 a year had lost their jobs. The third quarter has seen a decent level of economic recovery, at least compared to Q2. That recovery has benefited all the strata. It has just benefited those in the upper strata considerably more than those in the lower strata. There is no question those at or near the bottom need help (come on Congress – get your act together!), but things aren’t getting worse, they just aren’t getting better as fast as they could/should be.

- California and states in the Northeast have the highest unemployment rates in the country. Unemployment in California, as the largest economy by both output and headcount, is more than double the unemployment rate of 10 states, and at least 25% higher than 27 more. That is great news for those 37 states, but not great news for the US economy as a whole since California carries so much heft. New York, home of the fourth largest workforce (at least before the pandemic outflow), is one of only four states with worse unemployment than California, so also a drag on the national economy. In case you are wondering, the state with the highest unemployment is Nevada. With nearly 24% of the Nevada workforce historically working in leisure and hospitality (versus 11% nationally), and tourism being close to completely eliminated due to COVID, it is somewhat surprising that the Nevada unemployment rate isn’t higher than the reported 13.2%.

Prior to the 2008 real estate crash and recession it was often stated that the entire country’s real estate would never drop at the same time, and that even recessions were mostly localized around certain industries (oil for instance). The Great Recession was large enough that it impacted almost everywhere in the country. It may be to early to know, but if this recession plays out more like historical recessions the pain will be felt much more specifically than generically. Certain geographies will be hit hard while others prosper. Certain industries will be (are) decimated while others prosper. Certain types of real estate will struggle while other segments will flourish. Maybe the days of generic investing through index funds in a shotgun approach will revert to a stock pickers game. There is certainly much to be wary of in the investing world, but there is also considerable opportunity. We don’t have to place all our chips on red or black as alluded to in bullet point #1. Simply making solid investments with a little tailwind should produce strong long-term returns.

Happy Investing