I have long been a paid subscriber to the work of Grant Williams and his Things That Make you Go Hhhhmm letters sent out twice a month. Grant is a senior advisor to Matterhorn Asset Management AG in Switzerland, a portfolio and strategy advisor to Vulpes Investment Management in Singapore, and also one of the founders of Real Vision Television — an online, on-demand finance channel showcasing the brightest minds in finance. I am constantly educated and entertained by his ability to weave salient economic analysis into a humorous and easy to read narrative.

I found Grant’s recent “Two Men in a Boat, Part 1” distribution especially valuable as we sail through the uncharted waters of our current economic times, so I reached out to him to obtain permission to share it with the Altus Insight community. He was kind enough to agree.

For those of you who find this as informative and entertaining as I did, there is a second part to the story, unsurprisingly called “Two Men in a Boat, Part 2”. You can keep reading and become a member of Grant’s excellent service at www.ttmygh.com.

Enjoy!

Forrest Jinks

————————–

“Trust me”, The Captain said, “it will change your life in profound ways. There is nothing like being aboard a boat, under full sail. Cutting through the water, surrounded by silence with only the wind and the waves for company is a feeling like no other.”

Every time I sit down to write Things That Make You Go Hmmm…, I try very hard to find a way to convey important, timely and thought-provoking material in an entertaining and engaging way.

By far, my preferred method of accomplishing that is through the telling of stories. To me, stories are the most important way that we human beings can not only convey ideas to each other, but also pass them down through history to those who follow us.

This week, I’m going to relay a personal story to you – one that unfolded over the last seven days when I accepted a generous invitation to join a dear friend of mine on a boat for a few days in the Greek islands.

What follows is simply the story of our time aboard, and of our conversations during many hours at sea in weather which ranged from sublime to treacherous.

My friend is not merely an extremely wise man, but also, thankfully, an exceptional sailor and, over the course of our time together this past week, I found myself listening intently as he mused upon the art of navigating a vessel through seas of all natures and couldn’t help but spend hours in silent contemplation about the relevance of that which he had shared with me once I returned to terra firma.

The Captain (as he shall be called for the rest of this story), is a very private man who has had an enormous influence on my life and my thinking. Every moment spent with him has been filled with happiness, laughter, and the greatest of all gifts – wisdom.

At the end of my time with The Captain this week, I found myself reflecting upon so many valuable lessons and so I wanted to try something new in this edition of Things That Make You Go Hmmm… and share the story of our trip with you. I will leave each of you to, hopefully, take lessons of your own from our conversations, but, even if I fail to stimulate your brain in the way The Captain stimulated mine, you’ll at least be able to enjoy a nice story about a sailing trip!

Hopefully.

Athens greeted me with a smile – clear skies, sparkling sunshine and, happily, the arrival of September seemed to have taken care of the stifling heat common to many Greek summer days.

Waiting for me in the arrival hall was The Captain, his grey beard and beaming smile emerging from behind the mask he tore off as I approached him, his arms wide open. We embraced.

“Welcome to Greece!” he enthused. “We are going to have the most fantastic time! The weather has been perfect.”

I had been told to pack light “bring no more than a few T-shirts, some swim shorts and some good books.” and I’d complied, so I slung my small backpack over my shoulder and we walked to a tiny rental car.

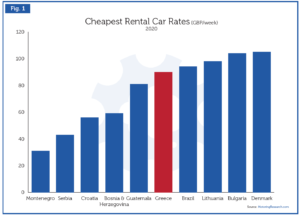

“Look at this.” The Captain said enthusiastically. “Fifteen euros a day! Can you believe that?”

(Greek Reporter): The number of tourist arrivals and revenue from tourism in Greece has taken a dramatic plunge due to the Covid-19 pandemic, with June revenue decreasing by 97.5 percent, as Bank of Greece data shows.

Specifically, there were only 256,000 arrivals in June (a 93.8 percent drop) corresponding to 64 million euros in revenue, a 97.5 drop compared to June 2019.

Tourism revenue for the first half of the year was 678 million euros, showing a 87.5 percent decrease compared to the first six months in 2019, when foreign tourism revenue reached 5.41 billion euros.

Travel restrictions was an important factor as well, as visitors from countries that traditionally travel to Greece – such as the United States, Russia and the United Kingdom -were not allowed in Greece in June.

EU countries showed a similar decline in tourism revenue and arrivals, with the decline being over 90 percent in nations with a high inflow of travelers.

To me, the airport and parking lot seemed eerily quiet – even though this was my first time in Greece – and so I asked The Captain whether this felt ‘normal’ (whatever that means in 2020).

“Oh no,” he said, “it’s very quiet. But that will be good for us.”

As we exited the parking lot and took the freeway ramp, I took a look at the passing landscape and wondered, given the enormous part tourism plays in the Greek economy, how other countries must be faring in the Covid Age.

(Modern Diplomacy): According to UNWTO, the massive drop in international travel demand over the period January-June 2020 translates into a loss of 440 million international arrivals and about US$ 460 billion in export revenues from international tourism. This is around five times the loss in international tourism receipts recorded in 2009 amid the global economic and financial crisis.

UNWTO Secretary-General Zurab Pololikashvili said: “The latest World Tourism Barometer shows the deep impact this pandemic is having on tourism, a sector upon which millions of people depend for their livelihoods…

Despite the gradual reopening of many destinations since the second half of May, the anticipated improvement in international tourism numbers during the peak summer season in the Northern Hemisphere did not materialize. Europe was the second-hardest hit of all global regions, with a 66% decline in tourist arrivals in the first half of 2020. The Americas (-55%), Africa and the Middle East (both -57%) also suffered. However, Asia and the Pacific, the first region to feel the impact of COVID-19 on tourism, was the hardest hit, with a 72% fall in tourists for the six-month period.

At the sub-regional level, North-East Asia (-83%) and Southern Mediterranean Europe (-72%) suffered the largest declines. All world regions and sub-regions recorded declines of more than 50% in arrivals in January-June 2020. The contraction of international demand is also reflected in double-digit declines in international tourism expenditure among large markets. Major outbound markets such as the United States and China continue to be at a standstill, though some markets such as France and Germany have shown some improvement in June.

Looking ahead, it seems likely that reduced travel demand and consumer confidence will continue to impact results for the rest of the year. In May, UNWTO outlined three possible scenarios, pointing to declines of 58% to 78% in international tourist arrivals in 2020. Current trends through August point to a drop in demand closer to 70% (Scenario 2), especially now as some destinations re-introduce restrictions on travel.

The extension of the scenarios to 2021 point to a change in trend next year, based on the assumptions of a gradual and linear lifting of travel restrictions, the availability of a vaccine or treatment and a return of traveler confidence. Nonetheless, despite this, the return to 2019 levels in terms of tourist arrivals would take between 2 to 4 years.

As we drove, The Captain explained to me that, as is common with matters of the sea, things had changed somewhat since we’d spoken on the telephone a couple of days prior.

“The forecast is for strong winds and higher seas these next few days.” he beamed. “Perfect sailing weather!”

On we drove, two sailors ashore, one making little effort to conceal his excitement, the other doing everything possible to mask his apprehension.

After stowing my backpack aboard the ship, we walked to the port for a bite to eat and chatted about our plans for the next few days.

The Captain was brimming with excitement and good ideas. “We will sail to Mykonos, anchor there for a day or two and then sail on to Paros. We will sail, swim, read, eat and talk about the world. There is much to discuss.”

After some delicious red mullet, a Greek salad (although, here it was simply called a ‘salad’*) and a carafe of surprisingly good local wine, we retired to our cabins and I was quickly rocked into a deep sleep.

Four hours later, I was woken by the sound of a thousand banshees wailing their collective lament for what must have been a catastrophic loss of souls. As the fog in my brain cleared, I realised it was merely the wind howling through the lines and rigging of the boats tied up in the small marina where we were berthed.

I failed to return to my dreams.

After breakfast (which consisted of orange juice and freshly-squeezed Dramamine), The Captain fired up the ship’s engine, various lines were untied and either cast ashore or stowed aboard and we began to gently maneuver our way between the hundreds of oscillating boats and out towards the open sea.

The shelter of the marina offered a false sense of calm, but, beyond the harbour wall, the tell-tale white caps strewn across the deep blue waters of the Aegean Sea suggested the plain-sailing was about to end.

Sure enough, as we left the safety of the harbour behind us, things changed. Dramatically.

The wind was blowing some 35 knots, with gusts up to 10 knots higher and the sea was a tempestuous, turbulent tumult. We sailed through this, each of us lost in our own thoughts. The Captain had plenty of variables upon which he needed to concentrate. I had only one – the future whereabouts of the contents of my stomach.

The Captain was in his element. Me, as I wrestled with my nausea? Less so.

“Sailing is like life”, he offered, his voice seemingly drowning out the wind. “The sea will never adapt to you. You must adapt to the sea. The water can be quite calm one moment and then, seemingly out of nowhere, a rogue wave can turn your world upside down before you have time to react if you are not paying attention.”

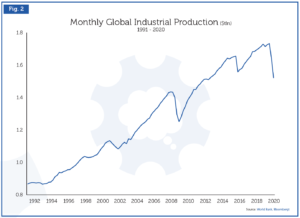

(Caixa Bank): A global shock of the first degree.

Although uncertainty is very high, given that the modern era has seen no comparable situation, the global coronavirus pandemic will most probably end up having economic consequences of an unprecedented scale in the short term…

Of course, how severely the virus will affect each country will depend on many factors, such as its health system, its own particular demographics (a young society in an emerging country is not the same as a country with an older population), its geographical structure (countries with a high urban density versus others that are less urbanised) or its degree of development.

But the pandemic’s evolution to date suggests that no country will escape being directly affected. Moreover, all economies are exposed, to a greater or lesser extent, to the slump in global demand. Nor will any economy be able to emerge unscathed from the disruptions experienced by global supply chains, as well as from the restrictions imposed on people’s movements internationally…

We are clearly going through the second great economic and financial crisis of the 21st century.

However, unlike the Great Recession of 2008, decision-making is now proceeding much faster. Generally speaking (at least in the world’s leading economies), the foundations are being laid for an exceptional response…

“The trick”, The Captain said, “is to always anticipate, but be ready to adapt. Every time I leave port, I have a destination to which I am headed. I prepare the ship, I check the weather and the seas and, importantly, I make sure that every passenger on my ship is headed to the same place I wish to go.”

“Well, it’s hardly likely that you’ll ever have someone aboard your ship who doesn’t share your destination, surely?” I ventured.

“Listen,” The Captain said, becoming serious for a moment, “in my life and in my work, having ‘passengers’ who don’t share your destination can be one of the most disruptive problems of all. However, fixing it is quite simple. Let me tell you a story.”

I settled in, aware that, in all the years I’d known him, The Captain had never told me about an episode in his life which didn’t resonate with me on a level far beyond the superficial.

“I was once approached by a man who wished me to manage his affairs. We spent a considerable amount of time writing an investment policy together – one which accurately represented the aims he was trying to achieve. It was two pages long and specified that we would invest mainly in fixed income securities with a small allocation to the equities of large US companies. Once drafted and agreed, we both signed it and it became a manifesto outlining our guiding principles.

“One or two years later, we had performed very well, maybe fifteen or seventeen percent return on our portfolio each year. The man called me and asked to see me so we arranged to meet for lunch.

“Over lunch, we reviewed the portfolio within the context of our investment policy and, once we had finished, he turned to me and asked me if I knew what Thai equities had done this past year. I told him I knew little of such things. “They were up one hundred percent”, he said.

“He then asked me the same question about Hong Kong equities. Again, I knew nothing, but was informed they had risen one hundred and twenty percent during the previous twelve months.

“I told him I was unaware of these moves and had spent no time looking at such exotic places, instead devoting my time exclusively to the markets in which I felt I had some expertise and understanding and which formed the foundation of our investment policy.

“Perhaps we should be investing more aggressively in Asian equities? These are serious returns we are missing out on.” the man said to me.

“I pulled out the two-page investment policy and laid it in front of him. Is that your signature? I asked him. He nodded. Nowhere in here does it talk about Asian equities. Nowhere does it say we should speculate to try and achieve outsize gains.”

I smiled, imagining The Captain’s demeanour during this conversation and making a mental note to check the charts of both the Hang Seng and the SET Index once ashore to see what had transpired, even though I felt sure I knew.

“So what happened?” I asked.

“I closed the folder containing the investment philosophy and told the man that he ought to seek alternative counsel as I was unqualified to manage his portfolio.” The Captain said quietly.

All the while he spoke, The Captain’s hands were on the helm as he navigated us effortlessly through the oncoming waves, steering first into and then out of each swell, with the kind of ease borne only of experience and confidence.

My own queasiness had dissipated somewhat as The Captain’s stories focused my mind on something far less troublesome to my constitution than the dramatic movement of the ship, but I was still left with questions.

“How do you stay so calm when things all around us are so crazy?” I asked.

“It’s important to understand the environment in which we find ourselves.” The Captain said. “When we left the marina, we knew the seas would be like this – at least, I did.” he chuckled. “I would not have left port had I felt that the conditions were beyond my expertise and so, knowing that, it becomes a case of adaptation. When the sea behaves in unexpected ways, you have to remain calm and adapt to the new conditions. If you become paralyzed by fear – which is easy to do – you are unable to act.

“When we set out, we knew where we were headed and we knew how we would get there, but when the conditions change, we need to have a contingency plan – a bolt hole. Are you familiar with that phrase?”

I confirmed that I was and asked whether we had a bolthole. Of course we did. We had already changed course towards it.

Having an experienced captain at the helm, one who remained calm amidst the storm, was remarkably comforting for me, a novice sailor. I was completely out of my element and, for one of the few times in my life, felt utterly useless.

No matter. The Captain was prepared and so our revised course would take us to a bay which would offer us shelter and a place to ride out the worst of the storm.

Getting to our bolt hole was no easy task but, once we arrived in the (relatively) calm waters of our anchorage for the night and secured the ship, we could finally relax.

Gin & tonics were poured, shoulders finally loosened and our conversation turned to the world at large.

“Even while we’re sheltered here,” The Captain said, “we must remain vigilant in case our anchor comes loose and we find ourselves at the mercy of the wind. You’d be surprised how often that happens. If our anchor came loose tonight, for example, we might end up on those rocks over there.” He pointed towards a nasty-looking shoreline.

“At night, in the darkness, with the wind howling, all your fears are amplified even though the situation is the same as it is in the light.

“When we can’t see, we become more afraid.”

The Captain sipped his gin & tonic thoughtfully, his mood subtly becoming a little more earnest, and he gazed out to sea as thoughts turned to words and tumbled from his lips.

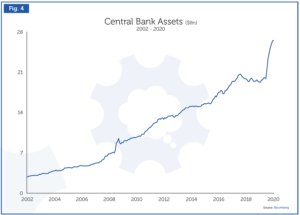

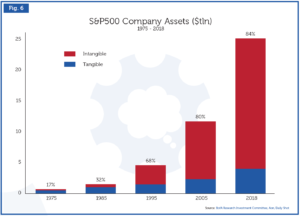

“Today, everything has become untethered. What has come to be known as ‘money’ is just ‘currency’. It has no value. It is simply created at will out of thin air.

“Today, we deal in intangibles. If you can sell intangibles to people, you will do very well. But this is nothing new. Man has been in search of a way to get rich by doing nothing for millennia.

“Since the Middle Ages, man has sought to create a perpetual motion machine which would be able to work for an infinite amount of time without an energy source. This idea has captivated mankind, even though we know it violates the rules of thermodynamics.

“The idea of success without work? Well that, for man, is the holy grail.”

The Captain chuckled. “Of course, we know that this is impossible, but it does not stop man from trying to achieve it”.

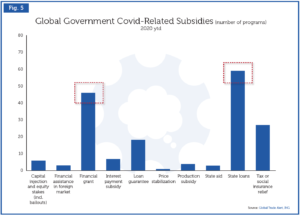

(ING): Governments worldwide have implemented subsidies as part of their responses to Covid-19, to bridge the drop in demand caused by lockdowns and continued social distancing. In total, additional spending and foregone revenue in G20 countries are equivalent to 6% of their combined GDP. Another 6% has been injected to boost liquidity through loans, equity and guarantees.

Global Trade Alert records more than 200 different subsidies granted since March 2020… The most-used form of support has been financial grants, including the EU Commission’s expansion of its Temporary Framework to allow financial support schemes. State loans and tax relief schemes have also been introduced in many countries with different target groups, often SMEs or firms in a particular region.

The EU’s Temporary Framework is a time-limited measure, which will run until December 2020 unless a further extension is agreed. However, two-thirds of the new subsidies have no end date. With this comes the risk that the subsidies introduced in the wake of Covid-19 open the door to negative long-term effects.

(LSE): Both in the UK and the USA, people were much more supportive of a UBI policy for the pandemic and its aftermath than they would have been in normal times. The effect was large and held across ages, genders, and political orientations…

People could represent the costs and benefits of UBI: they thought the simplicity of the policy to administer was a plus, as was its potential to reduce stress and anxiety by providing universal security. They thought the policy would be good for stopping people falling between the cracks, and would also be effective when people’s life situations were subject to rapid change, when presumably means-tested assistance schemes would struggle to keep up. On the other hand, many respondents were concerned about giving money to the rich, who don’t really need it; about whether UBI is the best way to reach those most in need; and some were concerned about effects on the supply of labour…

What the pandemic has changed are perceptions of the relative importance of those pros and the cons. Our respondents felt that the pandemic makes simplicity of administration a more central advantage than before…

Respondents also thought the pandemic made the need to reduce the stress and anxiety of the populace a stronger priority than before.

But they were specific about whose stress and anxiety had increased in these times: not the people who were already receiving welfare, but the big chunk of the population who did not rely on welfare prior to the pandemic. What our respondents saw the pandemic as having done, perhaps, is plunge a huge chunk of the previously secure population into the stress and insecurity previously characteristic of just a poor sub-group. We are all the precariat now. No wonder then, that rather than making the existing targeted system more generous, the respondents mostly favoured introducing the broader envelope of UBI.

Just as the pros of UBI suddenly look more appealing to our participants, the cons seem less pressing now…

“To me”, The Captain said, almost to himself, “Bitcoin is the embodiment of this phenomenon. What is Bitcoin? It is nothing. Nothing, and yet people flock to it with the hope of getting rich. It makes no sense to me.”

He was on a roll now and experience has taught me, in such circumstances, to just sit quietly and listen instead of breaking his concentration and so I made a mental note to return to the subject of Bitcoin later.

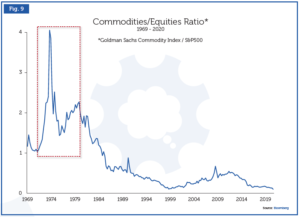

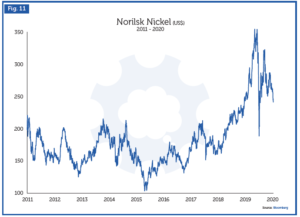

“Me?” The Captain pondered aloud, “I want to own something tangible. Something I can see, I can touch. Something I can feel.

“I have looked for a long time for a way to express this view but it is not as easy as you might think. I want to own something truly exceptional. I have always owned gold as a liquidity reserve and I will deploy it when I find something truly valuable.

“But such things are increasingly hard to find.

“Earlier this year I became interested in silver – not necessarily as a long-term holding, but it was clearly undervalued when compared to gold and so I looked into how we might acquire some. Storage of silver is not simple. It is large, it is bulky and it requires significant logistics.

“Exchanging some of our gold for silver made sense and we found a way we could do that through a Swiss ETF and be comfortable, so we did.”

I couldn’t help but interrupt at this point to ask The Captain what, to me, seemed like an obvious question.

“No.” The Captain replied matter-of-factly. “This is another advantage of having everybody on the ship going to the same destination. Our investors understand that we are primarily interested in the long-term preservation of their capital. So what do we buy or hold to preserve those savings? This is not an exercise that can be managed from quarter to quarter and our investors know that. It comes back to alignment.

“They know what we are trying to do and they know that our time preference is, essentially, infinite.

“It is not so easy as you might think.

“Finding exceptional companies with first-class management and exposure to the right commodities is difficult. But if you are prepared to look in places where others are either discouraged from investing or which are simply overlooked, you can find exceptional things. Valuable things.

“Something which is ‘cheap’ now because of where it once was is not ‘cheap’, nor does it necessarily offer good value.

“Investors’ memories are short and the past doesn’t exist in living colour. It is no more than a set of numbers which often bear no resemblance to the given conditions at a certain time.

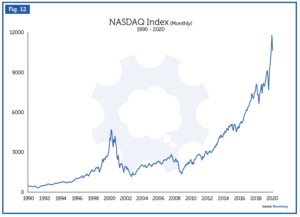

“Were tech stocks cheap in 2000? Of course not. Now, do they look ‘cheap’ then against where we are today? Some would argue they do.

The sun was beginning to set and, after a long day’s sailing, it was time to eat and get some rest.

The Captain insisted on cooking us a delicious meal in the ship’s tiny kitchen and the two of us sat on the deck, drinking beer and chatting until, a couple of hours later, the conversation began to peter out as our eyelids became progressively heavier.

I bade The Captain good night and retired to my cabin where I sat for an hour jotting down notes in my journal – notes which form the basis of that which you are now reading.

It hadn’t been my intention to share these notes with anybody, but our conversation had contained so much that made me think, I felt selfish keeping it to myself.

As soon as I closed my journal, my eyelids finally succumbed to gravity and, within seconds, the motion of the boat had once again rocked me into another deep sleep.

That sleep was unceremoniously broken by the sound of the engine starting up after what seemed like no more than a few minutes.

In fact, it was four hours later and, as I leapt up – banging my head on the cabin roof in the process – and, now an accomplished sailor, successfully navigated my way up to the deck, I felt completely disorientated.

The Captain was, once again at the helm, his eyes fixed on the radar screen which glowed brightly in the pitch black that surrounded him.

“Morning.” I mumbled. “I hope you weren’t trying to leave without me.”

“The anchor came loose. We are drifting out to sea.” he said, as he tried to maneuver the boat to a new anchorage. “Here, take the helm.”

The Captain returned to his cabin to get a little more well-deserved sleep, leaving me on watch – and watch I did.

I watched the helm, I watched the radar and I watched the shoreline emerge from the gloom as night turned to dawn. I took my eyes off nothing for several hours while the exhausted Captain slept.

As I sat there, vigilantly reflecting upon all that we’d discussed the previous day, I realised how fortunate I was to be taking this voyage with The Captain and just how much he always made me think whenever I had opportunities like our time together at sea.

One day into our passage and already I had so much to think about. Concepts like value, the importance of time preference and the protection of capital were not exactly new to me, but being reminded of them and having them framed anew by The Captain seemed incredibly timely as the world around me became more fragmented by the day.

This was the subject upon which I was musing when The Captain reappeared.

“Would you like a coffee?” he asked.

“Let me make one for you.” I replied. “Come and sit up here. It’s still pretty windy.”

Either my eyes had betrayed my strong desire not to challenge the sea again today, or The Captain was a mind-reader because, when I returned with his coffee, he ‘suggested’ that perhaps we ought to stay at anchor today rather than continue on our journey.

“The swell is going to be four-to-five metres again today with gusts up to 45 knots so why don’t we just spend the day here and we can reassess things tomorrow morning?”

“That’s too bad,” I replied, “I was looking forward to getting out there again. But, if you think we should stay here,” I added quickly, before he could offer me an alternative, “I’m very happy to do just that. Would you like some breakfast?”

I quickly disappeared below to obviate any further discussion and returned a short while later with two plates of scrambled eggs.

“You know, Grant,” The Captain said as he took the plate of eggs from me, “the nature of corporate man has changed. He is no longer interested in building anything of substance. Everything has become an exercise in generating a higher share price to enrich management.”

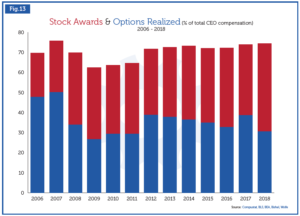

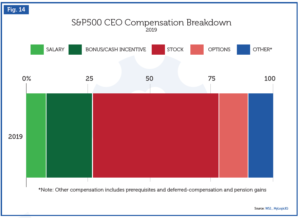

(EPI): For the period from 1978 to 2018, CEO compensation based on options realized increased 940.3%—between one-fourth and one-third faster than stock market growth (depending on the market index used) and substantially faster than the painfully slow 11.9% growth in the typical worker’s compensation over the same period. CEO compensation based on the value of stock options granted grew 1,007.5% over this period…

CEO compensation often grows strongly when the overall stock market rises and individual firms’ stock values rise along with it.

…the escalation of CEO compensation, and of executive compensation more generally, has fueled the growth of top 1.0% and top 0.1% incomes, generating widespread inequality.

In their study of tax returns from 1979 to 2005, Bakija, Cole, and Heim

Forty-four percent of the growth of the top 0.1%’s income share and 36% of the top 1%’s income share accrued to households headed by nonfinance executives; another 23% for each group accrued to households headed by financial-sector workers (some portion of which were executives).

“We own no investments in enterprises which compensate their management with stock options. None.”

The Captain was suddenly animated as he warmed to this particular subject and, as he continued down this particular path, I simply walked alongside him – trying hard not to think of Elon Musk and Tesla.

“This fixation on stock prices is a peculiarly American phenomenon. You just don’t find the same situation here in Europe. People – owners and management – are far less focused on their stock price and far more focused on their business. We can find plenty of companies who have just tremendous, tremendous businesses and, even though many of them have been expensive, the fall in March was wonderful as it gave us a chance to buy participations in a number of businesses we have coveted for a long time – though the window in which we were able to buy was too small and we couldn’t do everything we wished. There will be more chances, however, and we will be patient because we have time.

“You know, Grant,” he said, “people misunderstand time. It is our most precious asset because it is absolutely finite and we have no idea when our supply will be exhausted. Once consumed, it can’t be recycled and so we have to make sure we use it effectively. We have to balance its terminal decline with a sense of perspective. Even though it will eventually dwindle to zero, we need to be patient and have a considered plan for how we will use that time – a plan we must try to adhere to.

“Rushing to do this or that because time is running out can lead to big mistakes – like overpaying for an asset – and that short-term decision can create long-term problems. You must be considered in all things.

As The Captain returned to his eggs, I couldn’t help but push him on this point.

“But how do you reconcile that with the idea we spoke about yesterday?” I asked. “The idea about always being prepared and having a plan, but being ready to adapt to the changing seas?”

“You listened!” The Captain’s mock surprise was betrayed by his gentle smile.“ We are talking about different things here.” He said. “On every voyage, there will be periods when you have to be ready to adapt, but that doesn’t necessarily mean you must hurry to do so. Sometimes, you find yourself at a point in the ocean where there are cross-currents. When waves are coming at you from different directions, the sea can get ‘confused’ and so you must be ready to adapt but, if you change your course at the first sign of what may seem like settled conditions, you may be making a big mistake.

“Remember, the goal is the destination. You may have to find alternative ways to get there, but you must always keep your eyes on your ultimate goal. Because of the conditions, we may not get to Mykonos, or Paros on this trip and, because of the fact that you must leave in a few days, we may be forced to head back to Lavrion, but, if Panos was the place we had decided we MUST reach eventually, then we would shelter here until a window opened which afforded us the opportunity to get there safely.”

I nodded silently and lifted a forkful of eggs to my mouth. Of course, what The Captain said made perfect sense, and it wasn’t as though it came as a huge revelation to me, but there’s something about his ability to simplify things and distill them down to their essence which so few people possess. He always makes me think about old things in a new way – something that has proven tremendously valuable over the course of our friendship.

My reverie was broken by The Captain’s voice. “Grant, just as the sea was in turmoil all around us yesterday, so I find the world to be. Everywhere I look, I see discord, struggle and entire industries which need to adapt if they are to survive. If they don’t, well…” His voice trailed off.

“Take the investment management business. It is broken.” he said, forcefully. “Today, it is simply a matter of gathering assets. That, for the most part, is the incentive for managers – not the service of their clients.”

(The Investments Blog): During this CNBC interview, Warren Buffett and Becky Quick discussed the compensation of his two investment managers, Todd Combs and Ted Weschler:

BECKY: “Both of them were managing their own hedge funds before, and the compensation structure in Berkshire is very different than the two and 20 you would get if you were a hedge fund manager.”

BUFFETT: “That’s right. If they– last year they started with about five billion each. If they’d put it under the mattress under the standard hedge fund arrangement they each would’ve made about $100 million. I mean, that shows you how nutty the arrangement is.

But they would have literally made $100 million by sticking it under the mattress. If they put it in an index fund, and gotten the two and 20, they each would’ve made over $300 million. All they had to do was buy the vanguard index. And they each would’ve made over $300 million. They also would’ve gotten more favorable tax treatment on it then they got by getting a salary from Berkshire.

So imagine I mean, you can retire forever on $300 million. So one year you go, you put the money in an index fund so it just shows that the– it shows you amounts you get by asset gathering rather than asset managing. I mean even though a great many hedge funds in recent years have not delivered high performance, they’ve delivered high fees.

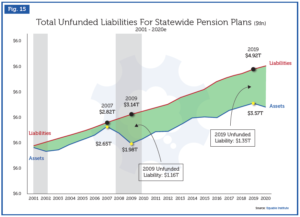

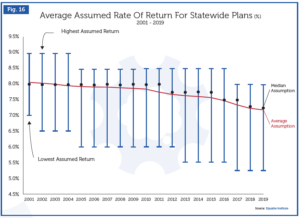

(Noozhawk): Battered by the coronavirus pandemic and low interest rates, public pension plans are headed for a record shortfall, posing risks to the living standards of millions of employees and retirees throughout the country.

The amount of the shortfall is a moving target because three-fourths of pension plan investments are in risky assets such as stocks, private equity or hedge funds in which values change daily.

Pew puts the total amount of unfunded liabilities for public pensions at $1.37 billion. The Equable Institute, a New York-based think tank, uses a figure of $1.62 trillion.

Because of the accounting methods used to calculate pension liabilities, the full scope of the COVID-19 impact on state pensions may not be known until 2022, said Anna Petrini, a senior policy analyst for the National Conference of State Legislatures (NCSL)…

“There seems to be a great need for everybody to check every price on a daily basis.” said The Captain. “From the CEO, whose compensation is based on the performance of the share price and not the company, to the individual investor who is fixated on short-term gains and losses.

“The more frequently you look at prices, the more frequently you have to guess and second-guess whether you should own something or not. I find this to be extraordinarily foolish.

“We own participations in great businesses. We do not need to check the price of the shares every day. Why would we? Does the CEO of any of these companies check his share price every day? I can assure you they do not. In fact, they are completely unconcerned about such things – instead focusing on delivering a great product and providing a better service to their customer.”

I cast my mind back to a previous conversation with The Captain during which he recounted a visit to one of the companies in which he maintained a participation. During that conversation, the subject of the share price accidentally came up, at which point the CEO casually asked The Captain what his share price was doing ‘these days’.

I tried to imagine a world in which that was the level of prioritization given by the average CEO instead of those inhabiting the very tail of the distribution curve, but I was singularly unable to do so.

Instead, I thought, we have something altogether different and far less productive for investors.

(Epsilon Theory): Here are some fun facts about Doug Parker and his “leadership” of American Airlines since he became Chairman and CEO of the company in 2013, after its merger with US Airways. All of this (and more) can be found in a long note I wrote on the airline bailout back in March.

From 2014 through 2019, Doug Parker pocketed more than $150 million in cash through his sale of 3.6 million shares in American Airlines. That’s in addition to the $50 million in stock he still owns (and net of the pittance that Doug has paid for all of these shares). That’s in addition to the $100+ million in cash salary and cash bonuses and deferred comp and stock options and incredible perks that Doug has received. Nope, cash comp and deferred comp are for suckers. Just ask Jamie Dimon.

These stock sales were particularly egregious in 2015 – 2016, where for a twelve month period Doug pocketed between $4 million and $11 million in stock sales per month, and again in 2018, when for a brief shining moment American Airline’s stock price went above $50.

Wouldn’t you know it, Doug just happened to choose that moment to sell 437,000 shares of stock, more than twice as much stock as he had ever sold before and almost 5x the usual size of his stock sales.

But surely, compensation like this is well earned. Surely, American Airlines has outperformed its competition, built a solid franchise, and delivered nice returns to its investors.

LOL. Don’t call me Shirley.

From 2014 – 2019, the same years that CEO and Chairman Doug pocketed $200 million in real money stock-based comp, American Airlines had *negative* free cash flow of $3.2 billion.

And took on an additional $14 billion in debt.

And bought back $13 billion of its stock.

How did all this work out for American Airlines shareholders from 2014 – 2019.

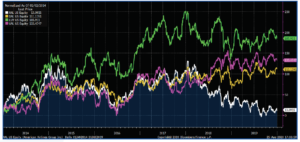

That’s American Airlines in white, Delta in yellow, United in purple, and Southwest in Green.

Over this six year period, AAL stock was up 13%. Not 13% per year, but 13% over SIX YEARS of the best bull market in history…

By now, the sun had risen above the rocks, casting light on the white caps in our sheltered bay and the wind was once again howling through the ship’s lines. The Captain surveyed the scene around us carefully and with his customary consideration.

“My dear Grant,” he said, “I suspect we won’t be going anywhere today so we should make ourselves comfortable and maybe we can instead spend the day talking about the world.”

I smiled, realising that, despite my pages of notes about what The Captain had said on our voyage so far, to him at least, that was simply chit-chat.

Today, we would sit and really talk about the world around us.

I couldn’t wait.

Sadly, Dear Reader, I’m afraid you’re going to have to do just that, however.

This edition of Things That Make You Go Hmmm… has been highly experimental and unlike anything I’ve attempted to do before so I can but hope I managed to achieve my aim. If not, I apologise.

The rest of this story I’ll save for another time – if you’d like to hear it – but I sincerely hope the first part of my time with The Captain has been as thought-provoking for you as it was for me. In the days that followed, we spent plenty more time in tremendously rough seas, sailed for hours in perfect conditions and took an unscheduled, but highly illuminating walk through the streets of Athens.

Through it all, The Captain provided me with homespun wisdom and an insight into building a philosophical framework by which one can bring order to a chaotic world and, when my journey was over, I found myself feeling far wiser for having taken it.

I sincerely hope you feel similarly having read about it.

OK, so besides nautical escapades, what else do I have this week into which you can sink your teeth? Well, plenty, is the answer, beginning with rising tensions between the beautiful country in which I spent the last seven days, Greece, and her neighbour to the East, Turkey, as oil rights in the Eastern Mediterranean continue to stir up emotions (and provide rather a convenient scapegoat/escape valve for an under pressure Erdogan).

Elsewhere, tensions are also rising in the sports memorabilia world, it turns out that your professional decline is coming sooner than you think (sorry, folks) and China, apparently, is killing the dollar.

I grasp the nettle and post what I thought was a thought-provoking article about Covid statistics and we hear why, in 2020, having no revenue is not a problem for the stock market.

Elsewhere, a major potential default in the Chinese property development sector has investors on high alert, the Covid pandemic is creating havoc in London’s media advertising and radio industries and the Australian government finds a uniquely… Australian solution to the problems facing the country as they decide responsible lending is really not something that needs to be prioritized.

Gotta keep that housing market from crumbling.

Finally, we have a few charts for you (including a look back to when Japanese banks ruled the world, a mighty pair of alligator jaws and the different attitudes to tech and energy & financial companies), interviews with mining legend Pierre Lassonde, the painfully brilliant Lauren Taylor Wolfe and a shameless plug for my own sports business-based podcast The Groundsmen and a warning from Gillian Tett that something (else) wicked his way comes.

That’s all from me for another edition, folks.

About the Author

Much to his chagrin, Grant Williams has reached 30 years in finance. Over that period, he has held senior positions at a number of investment banks and brokers including Robert Fleming, UBS, Banc of America and Credit Suisse in locations as diverse as London, Tokyo, New York, Hong Kong, Sydney and Singapore. From humble beginnings in 2009, Things That Make You Go Hmmm… has grown to become one of the most popular and widely-read financial publications in the world. Grant is a senior advisor to Vulpes Investment Management in Singapore, an advisor to Matterhorn Asset Management in Switzerland and also one of the founders of Real Vision Television—an online, on-demand TV channel featuring in-depth interviews with the brightest minds in finance. A regular speaker at investment conferences across the globe, Grant blends history and humour with keen financial insight to produce unique presentations which have been enthusiastically received by audiences wherever he has traveled.