Twelve months ago the country (re) elected a new president. At the time of the election there was considerable optimism among the business and investing communities. What has happened since has been far different than expected; to the detriment of many businesses, though, aside from a brief crash and rebound in April, to the pleasure of the broader investing community.

Attendees of our quarterly investor presentation have heard this song on our last two quarterly presentations: 1. The tariffs have severely impacted industrial leasing, and 2. Workforce housing, most specifically across the south, has been hit hard by the reverse immigration efforts of the administration. The impact of policy on any one particular business, or even business segment, doesn’t necessarily mean the policy is not good policy, but there is no denying the impact on our business, and the businesses of many of our competitors.

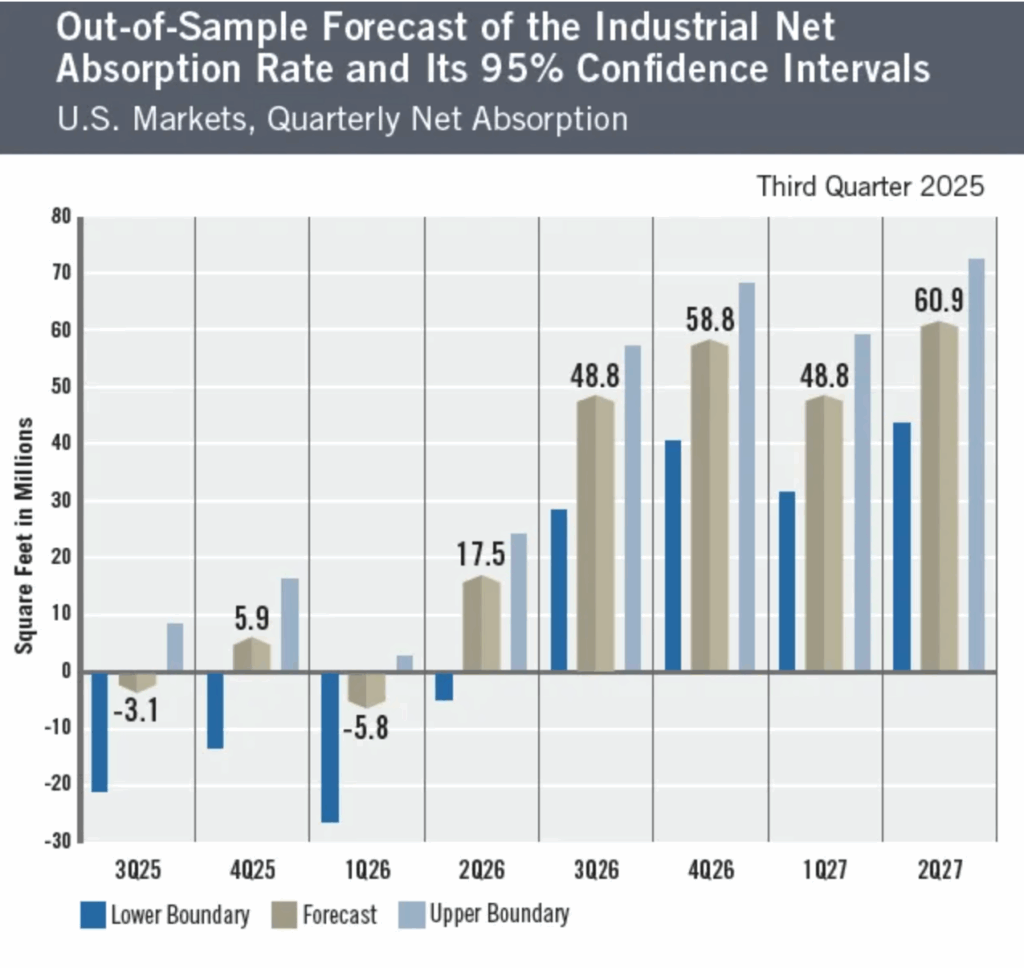

Leased industrial square footage has experienced steady growth since the Great Recession, interrupted only by crazy high growth in the years following COVID. Even over the past two years, while the growth rate was down substantially, net absorption remained positive. But now…well…the graph below says it all. If a contracting economy is a recession, then negative net lease absorption would have to be considered a leasing recession.

And that is where we are.

Previous Insights discussed the tariff situation. While some of the details have evolved, the meat of the matter has remained, so there is no reason for me to reiterate it here. In short: the implementation of the tariffs has been a mess, and the public logic used to justify them has often been unconvincing. That said, there is some justification for a meaningful portion of the tariffs that have been put in place. Only time will tell whether the actions taken end up being beneficial to the country.

Immigration, however, is another matter.

I am far less equivocal about the reverse immigration actions.

I fully support the deportation of criminal non-Americans. I also support controlled boarders – with clear and concise rules/steps to follow to immigrate to the United States.

But what is happening now, however, is asinine. The administration has said it wants to force one million people per year to leave the US. The Department of Homeland Security estimates, though certainly with a political agenda, that two million people have left the country so far in 2025. That is “more than 527,000” formal deportations and an estimate of 1.6 million voluntary self-deportations.

Many of the deportations have varying degrees of validity (though surely with errors mixed in), but it is the much larger number of “voluntary” self-deportations that is more concerning. For starters, it may not be all that voluntary.

We know from our own experience across 2000+ apartment units across Texas and Oklahoma that many (MANY) workers have not had their work permits (Employment Authorization Document – EAD) renewed.

This is really problematic. Setting aside my personal beliefs about the importance of (controlled/legal) immigration and focusing purely on economics, the math gets really ugly really quickly.

Remember, economic growth, which every economist that I have ever read believes to be a good thing, is dependent on two inputs: productivity growth and/or labor input growth.

Technically, labor input growth does not absolutely require an increase in population until the entire existing population is working 24 hours a day, but practically, changes in labor input has a high correlation to population growth over an extended time period. The Bureau of Labor Statistics reported a 2.3% increase in productivity during 2024 while the Bureau of Economic Analysis reported GDP growth of 2.5% for the same time period. That .2% difference is due to increases in labor input.

In 2024 the US population is estimated to have grown by ~3.3 million people, or roughly 1%. Of that growth, naturalized births/deaths contributed an estimated 520,000. This means there was ~2.8 million immigrants that moved to the US during 2024 and were part of that .2% of economic growth.

Fast forward to 2025:

Not only have 2 million left the US, but net immigration is also estimated to have dropped to ~500,000 (per the Federal Reserve Bank of San Francisco), a reduction of 2.3 million people from 2024. If we assume that the birth/death rate remains roughly the same at 520,000, the population change for 2025 can be assumed to be around a 1-million-person CONTRACTION! The birth/deaths have very little impact on the labor input part of the economic growth equation in that particular year (those close to birth and death are not generally in the work force), so in terms of economic impact the change in population is a reduction from 2.8 million positive to 1.5 million negative, and a change of 4.3 million in population. Further, while I can’t yet prove this with hard data, I believe that a higher population of those that left the country in 2025 were previously employed than those employed after coming into the country in 2024. This is from our own experience in losing residents (and lots of them). They had jobs! At least up until their work permits were non-renewed. Since we don’t have a quantification of the employment percentage difference, let’s go with the numbers we do have.

So + 2.3 million = .2% economic growth, or roughly .1% change per 1 million people. That .2% growth is wiped out entirely, with a contraction of .1+ due to the population loss, for an economic drag of .3%. Assuming similar productivity gains in 2025 as 2024 (a reasonable assumption), GDP growth will drop to 2.2%.

This is not a terrible number. At least not if you live in Seattle, Boston, or San Francisco – areas with smaller percentages of the work force being non-renewed.

But if you are Dallas, Houston or San Antonio? Or Phoenix? Or Albuquerque? Since the portion of the 2 million self-deportations across those southern border states is much higher than other parts of the country, the economic impact is also necessarily higher. Arguably another example of the 80/20 rule, 80% of the population drop spread across 20% of the US states.

Who is going to fill those jobs? How are small businesses going to continue to service their customers without those employees? How will businesses, especially small businesses that depend on the demographics inclusive of those self-deportations handle the drop in demand? We don’t know yet, but I believe it is going to be a much higher economic impact than is currently being contemplated by most; and certainly, being considered by the administration.

The narrative that “jobs are being freed up for natural-born Americans” doesn’t match what we’re seeing on the ground. Unemployment was/is already quite low, and the recent increase in job losses hasn’t been in jobs where the plurality of self-deportations were working.

Is the ex-Amazon engineer or AWS technician going to start hanging drywall? Or the ex-Microsoft programmer going to run a crew of landscapers? Uhhhh…maybe? But I wouldn’t place bets on it en masse.

These population changes will absolutely impact investment returns. Ignore it at your own risk. I can’t say that we ignored it, because we didn’t know it was coming and the impact on our business/portfolio was a first order result. There will be more unintended consequences.

But this is November, the month of Thanksgiving. I don’t want to focus only on bad news.

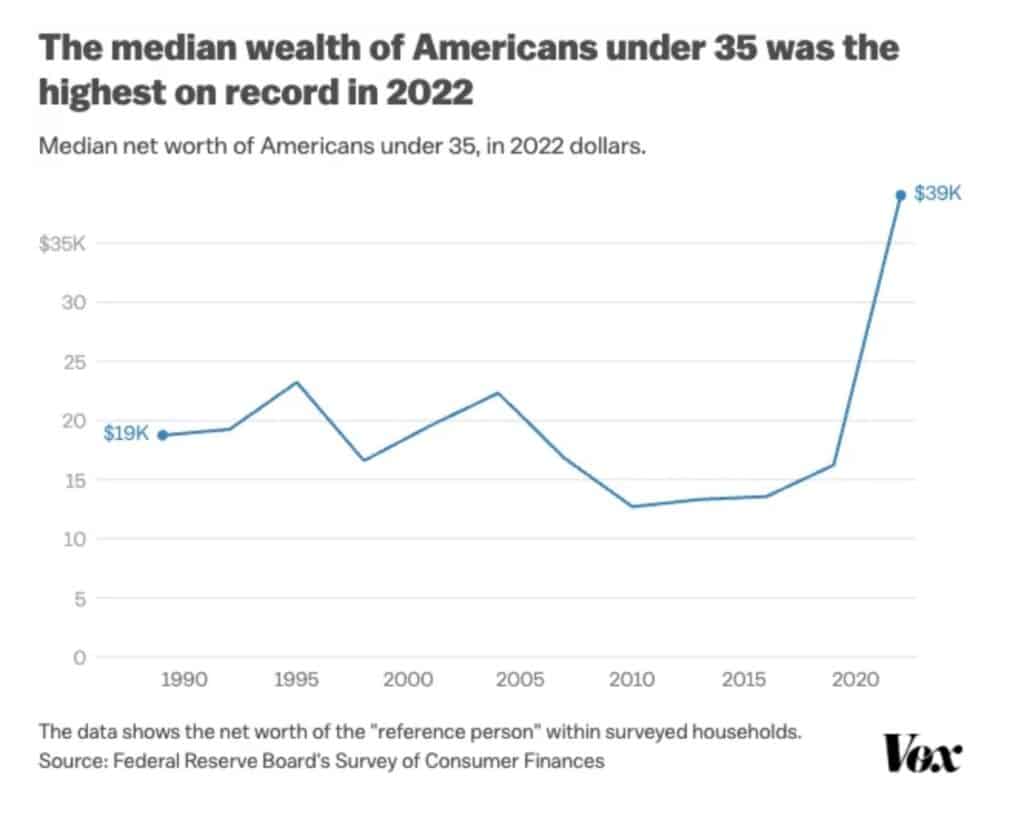

We hear often (and have occasionally discussed here in these Insights) that the middle class is shrinking. And if you ask the youngest generation in the workforce, they will tell you that no one has ever had it so tough.

But what if the middle class is shrinking because more people are moving up, not down (even when inflation adjusted)?

And what if Zoomers—contrary to their own perception—are the wealthiest of all generations at the same age, and their earning are much higher than previous generations?1

And what if the truth wasn’t at all what can be found in the daily mainstream press?

1 By many metrics, Gen Z is doing better than past generations. While housing costs and student loan debt are higher than they have been for previous generations, the unemployment rate among Americans 16 to 27 is the lowest in 50 years. In 2022, the median wealth of Americans under 35 was the highest on record, and the median 25-year-old made 50 percent more than a Boomer did at the same age. https://www.thefp.com

Happy Thanksgiving and Happy Investing,