Altus Mid-Month Update

November 2025

As we move into November and the season of gratitude takes center stage, we’re reminded not just of the lessons this market continues to teach—but of the people we’re privileged to walk through it with. At Altus, we’re deeply thankful for the trust and partnership of our investors, especially in a cycle that has tested conviction, structure, and discipline across the board.

Just as finding exceptional investments requires discipline, timing, and clarity—so does building relationships with the right investing partners. In both cases, we believe long-term alignment is what creates the most enduring value. We’re fortunate to have built lasting partnerships with investors who share our commitment to patience, fundamentals, and thoughtful growth.

That philosophy was front and center in our recent Altus Insight, “There Is No Alpha in Consensus,” which explored how outperformance rarely follows the herd. In a market where many are chasing the same over-leveraged strategies, we remain focused on opportunities where competition is limited, cash flow is present, and risk is priced appropriately.

We expanded on that theme in last month’s Insight, “Rethinking Risk,” where we challenged the conventional view that volatility equals risk. In our view, real risk is found in poor structure, weak execution, and the absence of margin for error—all of which we work to avoid through our underwriting and asset management practices.

This same philosophy underpins the Altus Secured Income Fund, which continues to see strong interest from investors seeking first-position, fully collateralized debt with predictable yield and downside protection. At the same time, our acquisitions, leasing, and development teams continue to pursue strategic opportunities across the Altus platform.

One example is our Lubbock, TX multifamily acquisition—a 279-unit, off-market portfolio with high occupancy and fixed-rate assumable financing. The project combines strong in-place yield with long-term upside potential—exactly the kind of contrarian, cash-flow-driven opportunity we’re aiming to deliver. Only a few investment slots remain available, so please reach out if you’d like to reserve a position.

This month’s update includes key developments across the Altus platform—from new acquisitions and capital deployment to meaningful progress in leasing and asset performance. As the broader market continues to shift, we remain focused on identifying overlooked opportunities, acting decisively, and creating long-term value for our investors. The road ahead will continue to reward clarity, discipline, and conviction—and that’s exactly where we’re placing our focus.

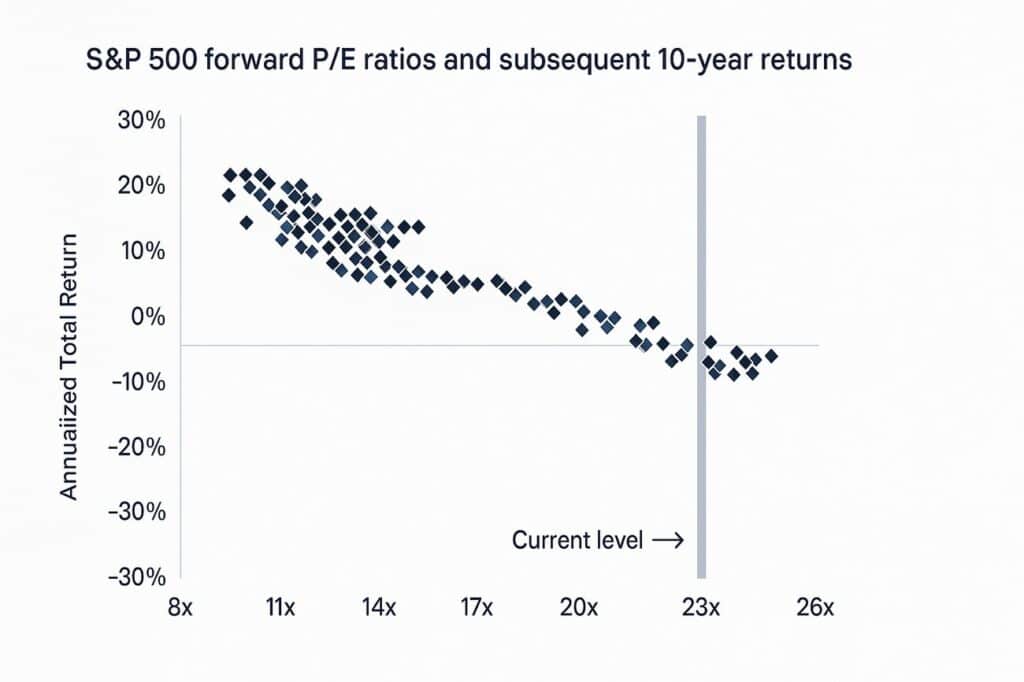

Valuations and Subsequent 10-Year Returns: The chart below was taken from our Q3 Investor Presentation hosted by Forrest, and it highlights a powerful long-term relationship between starting valuations and future performance. Each data point represents a month between 1988 and 2014, showing the S&P 500’s forward price-to-earnings (P/E) ratio at that moment and the annualized return over the following decade. The takeaway is unmistakable: higher starting valuations have historically produced lower future returns. In fact, during that 27-year period, when investors bought the S&P 500 at valuation levels similar to today’s—around 22x forward earnings—their subsequent 10-year average returns were 2% or below for 100% of all instances. Not only does this reinforces the importance of true portfolio diversification, but also solidifies the importance of buying when others are not.

See below for a recap of some of our projects underway:

Altus Secured Income Fund: Launched in September, the Altus Secured Income Fund is a new real estate–backed debt fund designed to provide consistent, passive income with meaningful downside protection. The fund offers an 8% preferred return plus 50% of fund-level profits, trued up at the end of each calendar year, with quality upside returns. It will invest exclusively in senior-position loans secured by real estate and provides reasonable liquidity after a short six-month seasoning period.

Industrial Warehouse, MS: We continue to make meaningful progress on multiple fronts at our Starkville Industrial asset. Most notably, we’ve reached the structure of an agreement for an option-to-lease with a Fortune 500 tenant for a substantial portion of the available space—moving us closer to securing a long-term lease commitment that would materially improve the property’s cash flow and occupancy profile. Final details are being worked through between parties. The tenant has already committed significant funds toward space improvements, signaling strong intent and alignment. Additionally, we signed a lease for 30,000 sq ft in a second building and are in the process of negotiating another lease for 40,000.

In parallel, we’ve agreed to a sale of a 10,000 SF outparcel building, and due diligence remains underway. Once complete, this sale—combined with an additional outparcel disposition in progress—is expected to reduce our overall cost basis by nearly 40%, all without impacting the leasable square footage or original underwriting assumptions.

Overall, we continue to see strong interest in the property, with multiple leasing discussions ongoing.

Highfill Duplexes Phase I, NW Arkansas: After another strong month of leasing this project is now fully stabilized at 94% with additional occupancy expected to be obtained over the next couple months. We have initiated the refinance process that will roll the debt into a long term fixed rate structure.

Multifamily Construction, Oxford, MS (Development): The Belle’s elevated design, modern finishes, and prime location continue to make it a preferred choice for both new students and residents relocating within Oxford. With current occupancy at approximately 65%, interest continues to build, including renters in nearby communities who are seeking a more refined living experience. In response, we are actively evaluating enhancements to the amenity package, including the potential addition of a pool area, to further elevate the resident experience and strengthen leasing momentum.

Leasing for next year is already in full swing with considerable success, as between leases already signed and applications out for signature, we are over 94% leased for next year. The refinance of this property will likely not occur until that occupancy kicks in next summer.

Oxford, MS: Multi-Family Project

Industrial, Dallas/Fort Worth, TX: The new brokerage team we hired has continued to gain traction after a slow start to the project, and we’re now seeing real momentum on the leasing front. Over the past month, we’ve executed two new leases and expanded an existing tenant, signaling strong tenant interest and improved market engagement. Multiple additional property tours have taken place, and multiple active lease negotiations are underway.

Fund Updates:

Altus Opportunity Fund: : The fund is scheduled to close at the end of this year, so if you’re interested in investing, please reach out. For more information on the Opportunity Fund, click here.

For those that are not already invested in the Opportunity Fund but are considering doing so, please click the link below to watch the replay of the Opportunity Fund webinar.

You can click here to view the replay:

Altus Capital Group – Private Money Lending: Altus Capital Group provides fast, flexible lending solutions for real estate investors across Northern California. Whether you’re navigating a partition loan, need short-term bridge financing, or are looking for a hard money loan to move quickly on a time-sensitive opportunity, we structure loans to fit the deal—not the other way around. With decades of combined experience across debt and equity, our team brings both speed and insight into the lending process.

We prioritize clear communication, simple underwriting, and tailored loan terms that align with your goals. Borrowers can expect transparency, responsiveness, and a streamlined experience from start to finish. If you’re exploring financing options for your next project, we’re here to help you move forward with confidence.

For more information on Altus Capital Group click here.

If you have a portion of your investment portfolio that is earmarked for debt, please reach out so we can add your name to our hot sheet. If you are trying to figure out the capital stack for your own project, feel free to reach out and we are happy to brainstorm possibilities with you.

Are you invested in any other real estate or debt investments that are struggling? We are actively looking for investment opportunities and have the ability and creativity to often be able help in challenging situations. Please contact us if you have or know of such situations.

For those looking to explore equity investments or private lending opportunities, please contact Chad Richards (crichards@altusequity.com), our VP of Investor Relations, at (707) 227-4422 or reply directly to this email. We’re here to help you navigate the investment landscape and identify opportunities that align with your goals.

Happy Investing!

The Altus Equity Team

Investors@altusequity.com

(707) 932-5887

This message is not an offer or solicitation of an offer to buy or sell any securities. Offers are made only by prospectus or other offering materials. The information contained herein has been obtained from a variety of sources which are believed to be reliable, but have not been independently verified, and may be subject to change without notice. To obtain further information, you must complete our investor questionnaire and meet the suitability standards required by law.