Twelve thoughts of Christmas

Originally written in the 1700s, the tune Twelve Days of Christmas that we have all come to know wasn’t placed with those words until 1909 when composer Frederic Austin put it all together into what is now played over and over each holiday season. With this being an electronic print-media, you will have to imagine the tune in your own mind as you read through the below Altus Insight.

Your email inbox is receiving this Insight on Christmas Eve, as we make our best effort for Altus to be closed for the week between Christmas and New Years to give our team a well-earned break. This means you will be receiving this Insight the day before the official first day of the Christmas twelve, at least according to the song, where the last day of Christmas falls on January 5th. You think 12 days of Christmas is long? This Altus Insight may make you change your mind by comparison. Note the hyperlinks inserted throughout this Insight for reference articles.

For the twelfth thought of Christmas…Congress gave to us…an approved infrastructure bill:

As I wrote previously, my belief is the country needs infrastructure spending, and as most readers will know, we got it. However, it was passed with no specified source of revenue to pay for the investment, AND in a time where the country is already dealing with the highest inflation impacts in 40 years.

“So, Forrest, if you are going to criticize, what would you have done differently?” Good question, glad you asked.

- This is an investment in what amounts to a government’s version of property, plant, and equipment (PP&E). Investments into PP&E are made only after an analysis is done to determine if those investments will create a favorable return. The investment is then made and paid for out of cash or debt. In our government’s case everything is paid for in debt, so we know debt will be used. An investment is determined to be worth making when the returns forecasted to be created by that investment are at a minimum greater than the risk adjusted cost of the investment (in the case of debt), or whatever else the company could do with those funds, such as pay dividends. For a government, dividends equate to a decrease in taxes. When borrowing, a government such as the United States has nearly unlimited ability to borrow. This means the calculus to determine if an investment should be made in the infrastructure should be measured by whether or not the infrastructure is able to pay for the cost of the borrowing (this is generally through economic growth leading to higher tax revenues). If the answer is no, we should absolutely not spend the money regardless of how much our bridges are crumbling, because we are just saddling future generations with more costs than the benefit they are receiving. If, however, and as I assume this to be the case here, the money spent on infrastructure has a net positive value above the cost of the finance, then the returns from that investment in infrastructure should be tied directly to paying for the debt. This is NOT deficit spending. This is investment. And by tying the investment directly to the debt, we can make sure that the investment is a good one. People might say this can’t be done, but in many parts of the country private infrastructure projects are more common, and those private investors figure out a way to make them profitable.

- Most politicians have not shown themselves to be adept at math or understanding accounting, finance, and economics. So, getting our elected representatives to understand the concept of there being a difference between a balance sheet and income statement may be a stretch. Without the acknowledgement of infrastructure as an asset (as would require a balance sheet), there can be no way to directly tie the debt service to funds needed to pay. So then how do we pay for it? The way the bill was approved, it is all just general deficit borrowing, which I dislike. If we aren’t going to tie the debt to the value/income created by the infrastructure then, as much as I hate to say it, changes should have been made to the tax code to ensure revenue to pay for the costs.

- The impact on inflation in destroying quality of life is greater than many of us on this distribution realize since we are fortunate enough to be able to absorb extra costs (and often have investments structured to benefit from the side effects of inflation). We have very real inflation right now (see below for more). Adding $1 trillion of additional cash infusion into the economy over the next several years is only adding fuel to the fire. I would have liked to have seen the approval include some sort of defined restrictions around the money being spent when inflation was below “x” percent or the economy was otherwise in a recession and needed the stimulus.

For the eleventh thought of Christmas, the administration is trying to give to us…Build Back Better (BBB):

As of the time of this writing, BBB will not be passed this year, and quite possibly not at all. I can’t say that I am sorry. Build Back Better is a horribly inaccurate euphemism for something that has no intention to live up to its name. Build = construct something new, Back = Replace, Better = Improvement. While there are some ideas in the bill that warrant discussion (easier access to childcare as an example), the vast majority is not building back something that was taken away or destroyed, it is a plethora of new social programs, most of them expensive, that aren’t building anything at all. Worse, the infighting of those that supported the framework stripped the bill of its revenue to pay for the cost, which in turn appeared almost certain to result in a tax break for the wealthy through a retroactive institution of the SALT write offs. Yes, I know the CBO estimated the bill would add “only” $365 Mil to the deficit over the next ten years, but that assumes all the programs included in the bill with one-year time horizons (or longer but less than ten) are allowed to expire. As Milton Friedman once said, “There is nothing so permanent as a temporary government program.” The non-partisan Committee for a Responsible Federal Budget estimated the true impact at $4.8 Trillion. With a T. That is roughly a 25% increase on the current federal debt (net of interagency holdings).

While the infrastructure plan that was passed is likely inflationary, at least the country (and the future generations that will pay for it) is getting something tangible out of it. Build Back Better is also inflationary (and almost certainly more so), but without investment. Spending versus investing.

For the tenth thought of Christmas, demand gave to us…supply chain issues:

At forty-four years of age, I feel like a college student again. Sleeping on a mattress on the floor. And not owning a dresser. We rented a property furnished, which included some of our personal furniture. That allowed us to buy a new bed, dresser, kitchen table, etc. At least in theory. Months later we still don’t have much of the furniture we ordered and, in several instances, after waiting months, our orders have been straight up cancelled. If it was just a Jinx (Jinks) thing (pun intended) we could chalk it up to us making really bad choices in where we chose to purchase furniture. But it isn’t just us. It is pervasive. And in business, supply chain issues are making things progressively more difficult. We are having to put deposits down for steel, roofing, insulation, and other type construction materials as much as 12 months in advance.

Washington and some news sources have implied that the situation is rapidly correcting itself and we should be back to fully stocked with short lead times early next year. I have no crystal ball, but I am skeptical. Those feeling like we are rapidly heading back to normal point to the fact that the ships waiting in line to unload at the countries largest ports are decreasing in number. The ports are certainly a big part of the bottleneck, so a reduction in ships waiting to unload would indicate progress. But what they fail to take into account is that there aren’t fewer ships waiting to unload at all, they are just waiting further out at sea or they are being forced to slow trawl to arrive at port later than originally anticipated (click here for the article).

There has been considerable commentary from lots of smart people on the subject of why we are having these issues, and I don’t have the education or experience to argue with them, but at a high level it all seems pretty simple.

- Pre-Covid supply chains were highly optimized so that equipment and labor force were efficiently used.

- Covid showed up, lockdowns happened, and services shut down.

- Additionally, the government gave most everyone large chunks of money that they didn’t previously have.

- People do three things with money: a. use it on goods, b. use it on services, c. save/invest

- Cash/income up, coupled with the ability to spend on services down = more money spent on goods.

- The vast majority of goods, especially consumer goods, come from outside the US, and a vast majority of what arrives from outside the US arrives via boat.

- For the purpose of this conversation, let’s call the 2019 supply chain capacity 100 units. Further, because of how optimized everything was, we can say the supply chain was operating at 95 units. The increased demand for goods pushed supply chain requirements up 10%, to 104.5 units. Suddenly there is an extra 4.5 units of demand on the supply chain system than it had the capacity to handle. At first this isn’t a big deal. But this increase results in 1 ship waiting off the shores of Long Beach. So what? Well, because there are still 4.5 more units of demand on the supply chain system. That one ship becomes two, then five, and then fifty.

- In normal times, participants in the supply chain would see the increased demand and proactively make adjustments (though such adjustments take time). That MAY be happening as we speak, but nowhere I have researched indicates it is happening at a rate that would be expected based on the supply constraints we are experiencing. Why? Expanding supply chain capacity is super capital intensive. If you are running a shipping company, are you willing to make huge investments in capacity when you can see that the increase in demand will eventually subside as a limited bucket of funds are shifted away from goods and back to services (as COVID fears subside)? Are you willing to make huge investments in capacity knowing that a massive tailwind to the increase in demand for goods was due to fiscal helicopter money that is unlikely to provide consistent extra income into the future?

In short, marginal increases in demand (due to government stimulus and restriction on spending on services) tips a system that is optimized for efficiency past full capacity.

For the nineth thought of Christmas, a shrinking (relative) labor force gave to us…labor shortage:

In February of 2020, just prior to the Coronavirus invasion, the unemployment rate (3.5%) was the lowest it has been since August of 1969. Said another way, it was the lowest it had been during the lifetimes of many of the Insight readers. Businesses were struggling badly to find help. Fast forward to the 2021 and businesses are again struggling to find help. While it feels more acute now than previously, it may just be that the areas in which shortages are coming to light are in more visible parts of the economy than in years past. Like with the supply chain issues, people have lots of different explanations. And like the supply chain issues, labor shortages are unlikely to resolve in next few months. Longer term though, there may be a silver lining here. Let’s consider some math (very rough, for illustration purposes). In March 2020 the US labor force was a little below 161 million people. A 3.5% unemployment rate indicated roughly 5.5 million people out of work that wanted it.

- It is no secret that the largest generation in history (baby boomers, at least until the millennials came along) is moving from working years into retirement years. Somewhere around 10,000 baby boomers retire EACH DAY, and that number has been increasing throughout the last decade. According to Pew Research, in 2020 the rate of retirements increased 3.2 million retirees over the retirement rate of the previous year. If we assumed that up until 2020 the number of boomer retirements was roughly offset by entrants into the workforce from the Gen Z generation, this acceleration would indicate a 3.2-million-person reduction to the work force, basically absorbing the entirety of the unemployed persons just prior to the pandemic. There are lots of reasons for the increased rate of retirement, partially due to natural demographics, but the government cash hitting bank accounts of those near retirement, paired with soaring retirement plan values as the stock market has continued to climb, has pushed many expected retirees past where they had calculated they needed to be to be able to retire.

- While morbid, the mortalities from COVID have to be taken into account as well. John Hopkins and the CDC estimate somewhere around 375,000 mortalities in 2020, of which ~25% were under the age of 65. This year has seen an additional estimated 440,000 mortalities. Not seeing data by age specific to 2021, lets assume it is roughly the same. Using a conservative workforce participation for those between 20 – 64 of 70%, this indicates of loss of workforce of somewhere around 150,000 people.

- Much harder to quantify is the number of people who left the workforce because they simply didn’t need to work (even before COVID), and don’t want to put up with the extra difficulties of working now. Around where we live there are a lot of people that fit this description. These individuals were working 20 – 30 hours a week in any number of industries in 2019, and now rarely work if at all because of the extra hassle (it is pervasive in health care locally). Having government stimulus providing replacement for their lost wages may also make it easier not to work, even if working was by choice in the first place.

- Childcare has been a huge issue. Even with schools back open, childcare continues to cause difficulties for many parents to be able to work the schedules they were working previously. This is a general childcare issue. Childcare facilities were shut down. Schools are in session less, so more childcare is needed but there isn’t the capacity to absorb the added demand, etc.

- Illness, and the impacts of illness on childcare is also an issue. A big issue. Roughly 50 million people have tested positive for COVID in the US. Those positives result in a minimum of ten days quarantine, and longer if more seriously ill. Assuming a 60% labor force participation rate (lower than above because we are applying it to the entire population), 30 million people in the work force have tested positive for COVID and have been out of commission 10 calendar days. Generally, this equates to 7 working days. With an average work year having 261 days, this equates to a workforce reduction of 804,000 people, or 402,000 each of the last two years. This is a huge impact. That doesn’t include people that tested positive but weren’t reported, people that quarantined because of close contact but never tested, or lost work time because of positive tests at work or at childcare. Granted, many people were also able to work despite being home with COVID, which offset the negative labor force impact to some degree. None-the-less, sickness has created major workforce shortage issues.

Like the supply chain, employment was fully optimized prior to COVID. Take full optimization and subtract capacity, and it is no wonder we are having issues.

As a side note, and something I have written about in previous Insights, Boston Consulting has been predicting a severe labor shortage for several years, even before the impacts of COVID-19. They believe that their forecasted shortage, which has since become an ever more acute reality, will accelerate the adoption of automation and A.I., and in turn lead to substantial unemployment by the end of the decade. It will be something to pay attention to as the years pass.

For the eighth thought of Christmas, the economy government gave to us…Inflation!:

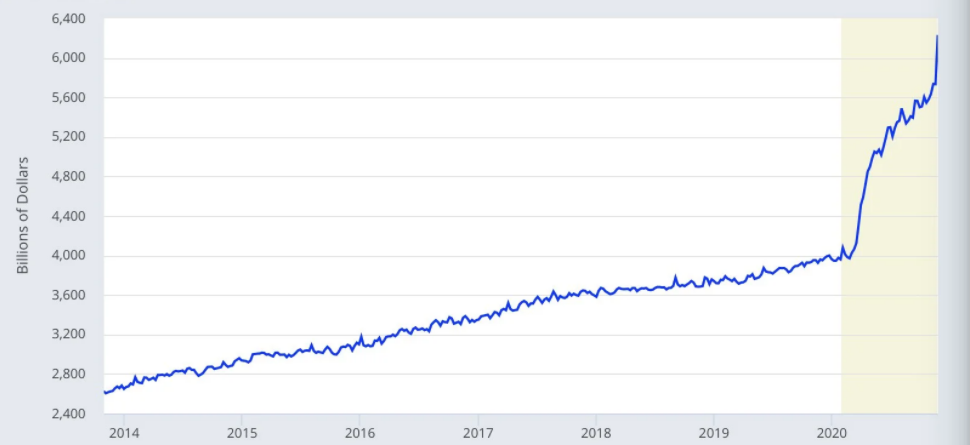

Inflation is velocity x currency. Velocity has been falling for years, and hence been a drag on inflation despite the best monetary efforts of the Fed to increase inflation rates. But fiscal policy has prevailed (if we can call it such) where monetary policy could not. The stimulus passed in March of 2021 in which $1400/family was completely additive to the stimulus that had already replaced the output gap caused by the impacts of the COVID response. From an economic perspective it simply wasn’t necessary. Additional stimulus since then (the child tax credit) has only added fuel to the fire. Below shows the huge spike to money in circulation, and hence we have inflation.

Inflation is a tax on savers and certainly a negative impact on those without savings or investments. The 6% headline number is the highest inflation rate in almost forty years. But I believe the real impact to be much worse. The cost of housing itself is not included in the CPI calculation because few people purchase their homes with cash. Instead, the government uses Owner’s Equivalent Rent (OER) and Rent of primary residence (Rent). Together those two items make up 30% of the CPI calculation. UNBELIEVABLY, those two inputs impact the CPI calculation based on homeowners’ answers to questions in the Consumer Expenditure Survey: 1. If you were to rent your home today what do you think it would rent for? 2. What is the rental charge for this unit if not owned. The second question…isn’t so bad. The first question is ridiculous. We have highly intelligent data companies that can track asking rents data down to a single day, and we are basing a large part of a retirees’ social security payment adjustment on asking a homeowner what they would rent their home for? How many homeowners keep up on the rent for their own home? Shoot, I live in this stuff 12 hours a day and I don’t know what the rent would be for my home. Long story short, the way that housing is currently being calculated in the CPI index is a drag on the inflation number, meaning that 30% of the weight is well below the headline 6% reported. If we instead looked at real market data that says rents increased over 10% across the country last year the true CPI number would be much, much higher. My rough math indicates a number just under 10%. What would the narrative be if we had a 10% headline inflation number?

Good news though, if nothing else inflation rates should moderate in Q1 simply because of a higher denominator used in the calculation.

For the seventh thought of Christmas, the Federal Reserve gave to us…the promise of tightening and rate increases:

Except that it isn’t really tightening, at least not for quite some time. It is a slowing of the loosening. Tightening would be selling purchased debt instruments back into the private markets to pull liquidity out of the economy. That is not what is occurring. The Fed is just purchasing debt (adding liquidity to the economy) at a slowing rate. This is a big difference. The real question to me is if they do make it all the way to tightening (or neutral) without reversing course, will it matter to inflation? For over a decade the Fed tried to use monetary policy to increase inflation with basically zero success (for additional examples see Europe and Japan). Massive fiscal intervention did cause inflation. I am more and more skeptical that monetary action can reverse inflation not caused by monetary action. This inflation has occurred DESPITE no real reversal in the trend of velocity of money. The hope with the monetary policy is that it would increase velocity. It didn’t, so what is reversing the monetary policy (i.e. increasing interest rates) going to do? We will see…

There are additional headwinds to the Fed’s actions. The tightening actions, in theory, should increase borrowing costs (which reduces leverage in the economy and reduces the velocity of money). But what if the higher cost of capital kills projects whose elimination is by definition inflationary? Or said another way, if those projects have inelastic demand, which is usually caused by government intervention in the economy, the higher interest rates will be passed straight through to the consumers as increased costs. Increased costs = inflationary. Which leads us too…

For the sixth thought of Christmas, supply chain, labor issues, and politics gave to us…energy shortages:

Energy transition, while probably useful long term, is without question hurting the poor. For instance, natural gas pricing in the Netherlands is up 8x this year alone. This is partially due to geopolitical issues, but renawables are not able to hit the supply levels promised, putting more demand on gas supplies than anticipated, and thus driving prices higher. Dramatically higher. While we might not like it, many of us can afford our power bill increasing from $40 to $400 per month, but this simply isn’t true for much of society. The growth of renewable energy production is hampered by the same supply chain issues as discussed above, which should hopefully work themselves out with time. An issue of larger concern is based on current technology we know that there is an absolute upper bound on the production of new capacity or storage due to the natural resources needed for the energy systems being limited in nature. The sun and wind do no produce power on demand, so for utility grade utilities without hydro, nuclear, or carbon fired plants as back up, massive batteries are needed to support periods of low production (i.e. several days of clouds) and peak demand (a cold snap). There are simply not enough resources to build the batteries needed.

At the same time, and likely for good reason, governments are making it increasingly difficult for oil and gas producers (and coal) to provide fuel to the world. On one hand we have replacement energy that isn’t able to ramp up as quickly as we had hoped, while on the other hand we are forcing the reduction in carbon fuels more quickly than the market otherwise would do so (on a population relative basis). This can lead nowhere but to shortages.

Increases in interest rates will act as a brake on development of new renewable energy supplies because there is such a large cap ex component to the projects. Instead of reigning in inflation, at least for energy, higher interest rates will result in higher inflation.

There is a solution to bridge the gap, but few people are willing to consider it. Nuclear.

For the fifth though of Christmas, energy issues gave to us…likely food shortages:

Natural gas is required to make fertilizers, accounting for between 75% and 90% of the operating cost in nitrogen production. Nitrogen is used in higher quantities than any other fertilizers. Like them or hate them, fertilizers dramatically increase crop yields. The increase in prices of natural gas have both raised nitrogen fertilizer prices and reduced supply because suppliers simply can’t afford to manufacture the fertilizer.

This has led several countries, most notably China and Russia, to restrict exports of fertilizers. This will in turn impact countries in SE Asia and Eastern Europe. That then will impact food prices even into western Europe. History is replete with examples of dramatic increases in food prices leading to social unrest. I anticipate our own substantial food price increases over the last year (9.6% November over November) will be nothing compared to what will be seen in more severely impacted countries. For those of us in the US, the good news is that the US has enough domestic fertilizer (and domestic natural gas) production that we will not be as impacted as other parts of the world. Watch for the rising food prices in the latter part of 2022, but possibly as early as late April and early May.

For the fourth thought of Christmas, hindsight gave to us…the unexpected (and mostly unacknowledged):

Turns out the Tax Cuts and Jobs Act of 2017 wasn’t to the benefit of the rich after all. Independently of each other Yahoo News and The Hill published analysis from IRS data of the impacts of the tax changes on the various tax brackets. While all tax brackets benefited from the Act, their analysis shows that lower-middle and middle-income households benefited the most, at a rate of 2 – 3 times the benefit received by those in the highest tax bracket. Hindsight…

For the third thought of Christmas, all the above gave to me…the expectation for a wild and crazy 2022:

As crazy and unexpected as 2020 and 2021 were, I don’t think we have seen anything yet. This may not be a bad thing for wealth creation because volatility creates opportunity. With mid-term elections coming up, the federal government is going to have lots of motivation to be fiscally stimulative. As has been the case for many years and is increasingly so, those that know how to play the game will be given every benefit for doing so. Often at the expense of those that do not. As the game continues to change, I want to make sure I continue to learn and evolve along with it.

For the second thought of Christmas, my life gave to me…More Blessings than I can possibly count:

Thank you to my family, friends, team, and business relationships for making it all possible.

And a partridge in a pear tree.

Happy Investing!